- This article explains how to transform various types of assets into bankable assets (exchange-listed products) and the future trends of these financial instruments.

- The information may be valuable for advisors or portfolio managers looking to securitize investment strategies to enhance distribution and facilitate access to international investors.

- Thanks to FlexFunds solutions, asset managers can efficiently and cost-effectively transform any type of asset into a bankable asset. If you wish to delve deeper into FlexFunds’ products and find the solution that best suits your needs, feel free to contact our team of specialists.

Bankable Assets Can Be Distributed Through Private Banking Platforms

Modern securitization strategies have become a bridge to reach multiple investment platforms, streamlining the process of converting underlying assets into bankable assets.

Bankable assets refer to asset types characterized by their distributability across various financial platforms.

Among these assets, exchange-listed products (ETPs) stand out, converted through a securitization process, such as that offered by FlexFunds, a leading provider in the design and issuance of investment vehicles.

FlexFunds’ securitization program facilitates access to multiple private banking platforms.

Which Assets Can Be Converted into Bankable Assets?

One of the significant advantages of securitization is that the investment strategy is not limited to a particular type of asset. Both liquid and illiquid assets can be included.

Treating them as debt allows for quick ETP registration with FlexFunds, in contrast to traditional funds’ tedious and lengthy procedures subjected to complex verification processes due to private banking KYC policies.

What Is the Conversion Process?

The process of converting assets into bankable assets through an ETP is straightforward for FlexFunds clients. They only need to select the assets they want to securitize.

Subsequently, FlexFunds handles the ETP issuance process, corporate administration services, and fund accounting, ensuring that the ETP is ready in less than half the time and cost of any other existing alternative in the market.

After completing the procedure, the portfolio manager can market their ETP, consolidating various assets into a single investment vehicle.

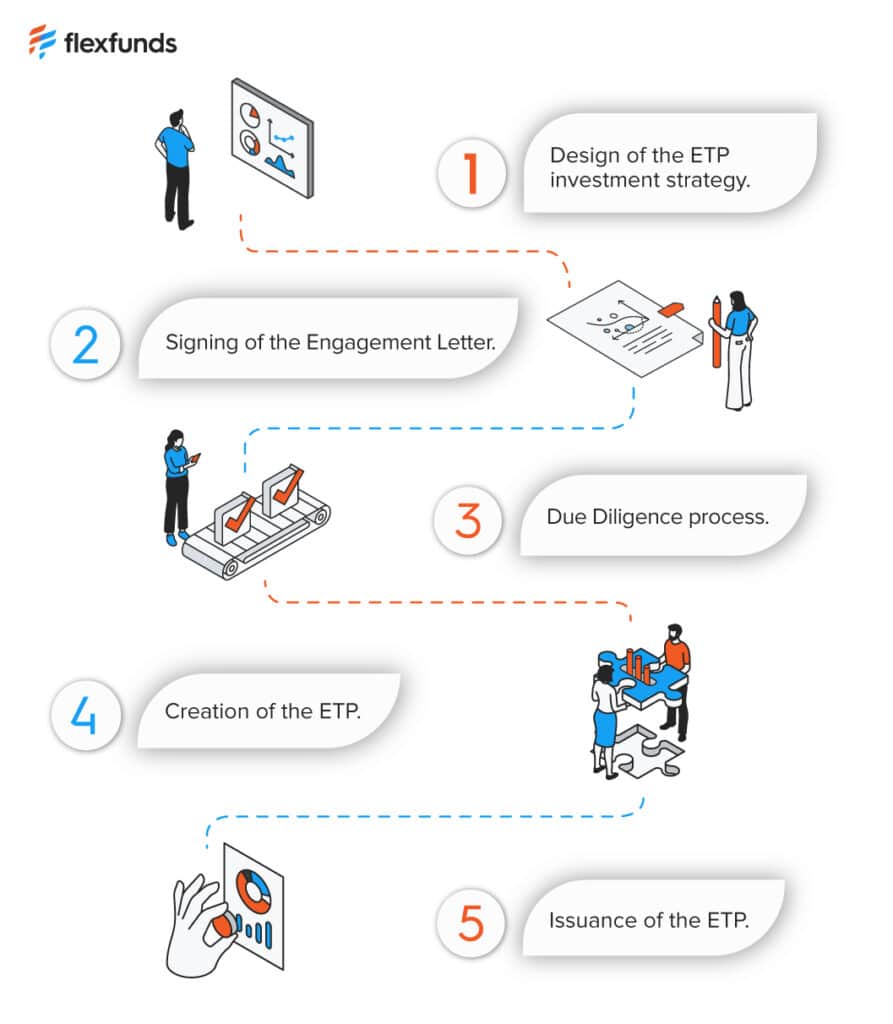

In just five simple steps, you can launch your ETP into the global capital markets, facilitating investor access.

Let’s recap:

- Design of the ETP investment strategy.

- Signing of the Engagement Letter.

- Due Diligence process.

- Creation of the ETP.

- Issuance of the ETP.

If you wish to proceed with the creation of an ETP, please contact our team of specialists.

About ETPs and Their Future

The ETPs are listed on the stock exchange similarly to equities, which means that their prices can fluctuate on a daily basis. However, their value change in accordance with variations in the price of the underlying assets.

Since the debut of the first ETF in 1993, ETFs and other ETPs have significantly grown in size and popularity. As of September 2023, worldwide ETFs had over $10 trillion in assets under management (AUM), according to ETFGI, an independent ETF and ETP research and advisory firm.

The low-cost structure of ETPs has contributed to their popularity, attracting assets away from actively managed funds characterized by higher costs.

Trends Through 2024

According to the 1st Report of the Asset Securitization Sector, based on a survey of nearly a hundred portfolio managers and investment experts from Latin America, the United States, and Europe, the investment fund sector and asset securitization are evolving and must continue to do so.

There is increasing scrutiny from regulators and investors regarding fees, intensified by growing competition.

To face this challenge, portfolio managers must become more efficient, reduce costs, and expedite response times through the adoption of new technologies.

Centralized account management, along with automation of net asset value calculation and reporting, emerges as a significant need for administrators.

This change has the potential to optimize investment strategies, allowing for efficient rebalancing of investments between accounts, improving yields, and reducing transaction costs.

Centralized management would simplify regulatory processes, streamlining onboarding and crucial compliance tasks during user account opening and closure.

In conclusion, the widespread perception is that the ETF and other ETP industries are increasingly consolidating as powerful management tools that will continue to grow, especially with technological advancements.If you want to learn more about exchange-listed products and how you can benefit from them, feel free to contact our specialists.

Sources:

- https://etfgi.com/news/press-releases/2023/10/etfgi-reports-year-date-net-inflows-global-etfs-industry-us59675

- https://www.flexfunds.com/wp-content/uploads/2023/11/FlexFunds_Annual-report.pdf