- Securitization allows the conversion of an asset or asset portfolio into listed securities, also known as Exchange-Traded Products (ETPs).

- Discover the five steps of the asset securitization process for cost-effective custom ETP issuance.

- FlexFunds is a leading provider in setting up and launching investment vehicles, offering one of the most advanced securitization programs.

The asset securitization process: optimizing investment strategies

At FlexFunds, we coordinate all the necessary steps to provide fund managers with unique and innovative ETPs.

Through these investment vehicles, asset managers and financial advisors can expand the range of products they offer to their clients.

In this article, we explain the asset securitization process step by step.

What is the asset securitization process?

Asset securitization is simply the transformation of an asset or a portfolio of assets into listed securities.

The securitization process can be pursued with various objectives; one of the most common is to provide a flexible structure to the investment strategy, making it easier to distribute among subscribers.

It can also be the case that the underlying asset is illiquid (such as real estate), and securitization aims to provide greater liquidity.

Whatever the objective and assets for securitization, at FlexFunds, we specialize in creating ETPs fully adapted to your needs through this process.

With over a decade of experience in this field, we have issued over 250 investment vehicles for over 200 clients worldwide.

Our mission is to offer you a high-quality ETP at a competitive cost, which can be launched into the market in half the time of any other existing alternative, enhancing its distribution in international private banking.

Which assets can be converted through the securitization process?

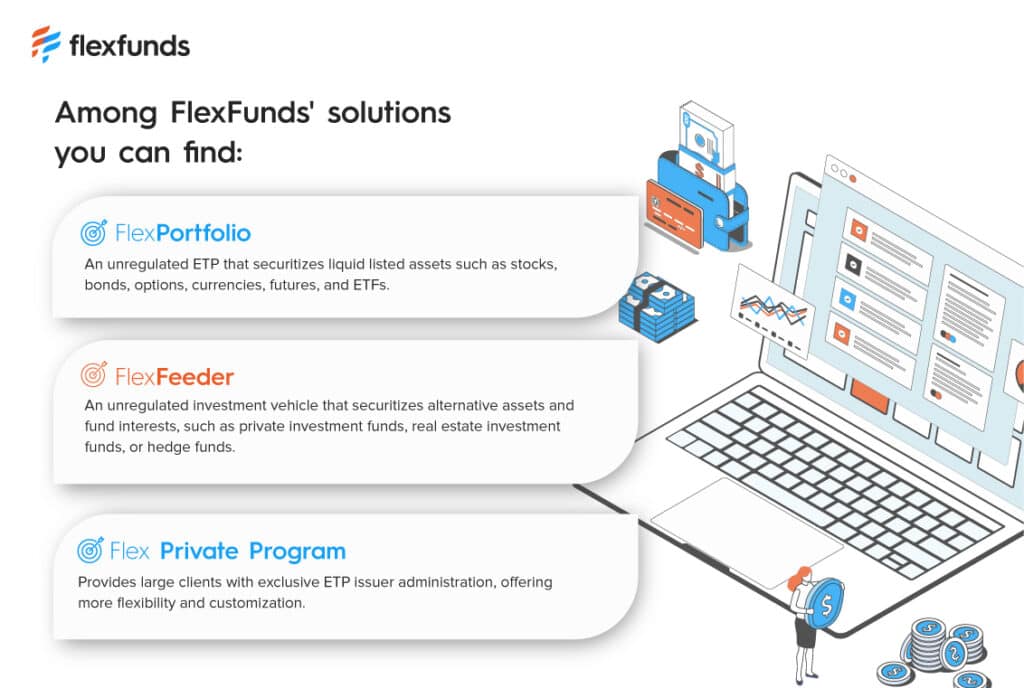

With FlexFunds solutions, you can repackage multiple classes of assets, such as liquid, alternative, or custodian-listed assets:

- Liquid assets: such as stocks, bonds, ETFs, mutual funds, options, futures, and currencies.

- Alternative assets: private investment funds, real estate investment funds, hedge funds, and private loans.

How does the asset securitization process work?

The asset securitization process is straightforward for FlexFunds clients. All you need to decide is which asset or groups of assets will act as the underlying, and then contact one of our representatives.

FlexFunds coordinates the ETP issuance process, corporate administration services, and fund accounting.

In just five simple steps, you can launch your ETP into the market and provide access to investors in global markets.

Step 1. Custom study and ETP design

Since the securitization process can involve various assets (both listed on secondary and private markets), it’s necessary to analyze each case and provide a tailored solution.

After contacting FlexFunds, a detailed study and data collection are conducted to offer a personalized solution.

FlexFunds collaborates with renowned international providers to coordinate the creation and issuance process of the most suitable ETP for your needs.

Step 2. Due diligence and engagement letter signing

Once the product structure is defined, the risk committee studies and evaluates the case.

Subsequently, the engagement letter is signed – the contract specifying the terms and conditions of service and the scope of functions FlexFunds will perform.

Step 3. ETP structuring and document review

During the securitization structure, close collaboration with the client is necessary for proper documentation development and shaping the ETP. In this step, the portfolio manager is onboarded.

Structuring concludes after drafting and reviewing essential investment vehicle documents such as the series memorandum, constituting instrument, and the portfolio management agreement.

Step 4. ETP issuance and listing

Asset securitization is now a reality. At this point, your investment strategy is repackaged within an ETP. Listing is the next step, along with generating an ISIN/CUSIP for distribution facilitation.

The issuer of the securities is an Irish Special Purpose Vehicle (SPV) established for this purpose. The issuance is backed by the investment strategy itself, acting as collateral.

Step 5. ETP ready for trading via Euroclear

The asset securitization process concludes with ETP issuance and listing, making it ready for distribution.

Investors can easily access the ETP by purchasing the securities on Euroclear through their brokerage accounts from numerous custodians and private banking platforms.

The asset securitization process aims to make a range of assets more accessible and internationalized, enabling access to other investors. It’s a secure and straightforward way for an asset manager, for example, to open its doors to international markets and expand its investor base.

Asset securitization example

A real estate sector company aims to reach a greater number of investors in its business goal.

To achieve this, it decides to assemble a portfolio of real estate assets: residential and/or office buildings and create a Flex.

Thanks to this investment vehicle, it can break boundaries by enhancing the distribution of the investment strategy across different international private banking platforms.

FlexFunds’ solutions for the asset securitization process

As mentioned earlier, FlexFunds is a leading provider in designing and launching investment vehicles, offering one of the most advanced asset securitization programs. This improves investment strategy distribution and facilitates access to international investors.

The launch time for these ETPs is half of the time required by other alternatives in the market. FlexFunds’ ETPs allow you to have a unique ISIN code that can be distributed through Euroclear.If you want to learn more about the asset securitization process and how you can benefit from it, don’t hesitate to contact our team.