- This article explains what index funds are, how they work, and why they are becoming increasingly popular.

- The information is aimed at asset managers who want to deepen their knowledge of the index fund industry to build more diversified and comprehensive strategies.

- FlexFunds offers an asset securitization program that enhances the liquidity of many index funds. For more information, feel free to contact our experts.

Currently, index funds are among the most popular investment vehicles in the world. In fact, according to the Verified Markets Report, the industry of these funds reached around USD 6 trillion in 2024 and could grow to USD 13 trillion by 2033.

For this reason, it’s worth understanding exactly what an index fund is, how it works, what benefits it offers, and what some of the most prominent funds are globally.

What is an index fund?

An index fund is a Collective Investment Institution (CII) with an investment policy based on replicating the behavior of a specific market index.

In this type of fund, the manager’s role is secondary: the goal is simply to construct a portfolio that mirrors the reference index and make periodic adjustments to keep it updated according to changes in that index.

For this reason, the index management philosophy is also called “passive management.”

Among the main features that define index funds, we can highlight their low management fees, precisely because they do not maintain active management, and minimal intervention from the manager.

Index funds typically have management fees ranging from 0.03% to 0.2% per year. In comparison, actively managed funds have costs ranging from 0.5% to 1.5%, or even higher.

How do index funds work?

The operation of index funds is simple. These financial products are investment funds, so they have a collective asset pool, without legal personality, and are managed by an administrator.

For an investment fund to remain active, two types of entities must intervene:

- The management entity: responsible for the administration.

- The custodian entity: responsible for holding the securities and cash.

The management company has the ability to issue and withdraw shares, ensuring liquidity for the investor.

The manager can track the index’s composition and purchase the securities in the same proportion— in other words, physically replicate the portfolio.

However, they may also use financial derivatives, such as futures contracts based on the underlying reference index. All these characteristics are determined in the fund’s regulations.

Regarding the indices that are used as benchmarks, they can be either fixed income or equity indices. There are also sectoral, global, and commodity indices. Therefore, there are index funds in various categories.

What returns do index funds provide?

The idea behind index funds is to replicate market movements, not to outperform the market.

An index is merely a statistical calculation (typically a weighted average) of the most representative securities traded in a specific financial market (those with the highest capitalization and trading volume). Its purpose is to measure the performance of the market it represents as a whole.

For example, an S&P 500 index fund follows the performance of this index, which consists of the 500 largest U.S. companies, weighted by size.

The return of an index fund is directly linked to the performance of the market in which it invests, represented by the corresponding index.

The ability of a fund to deviate from its benchmark is determined by the “tracking error,” a ratio that measures the difference between the portfolio’s return and its benchmark. In this sense, index funds typically have a very low tracking error.

However, as a general rule, the return of an index fund is slightly lower than that of its benchmark. This is because daily fees and other expenses are deducted.

What are some of the most prominent index funds?

Currently, there are thousands of index funds worldwide, each based on a different asset index. But there are a few that stand out from the rest due to their size and relevance:

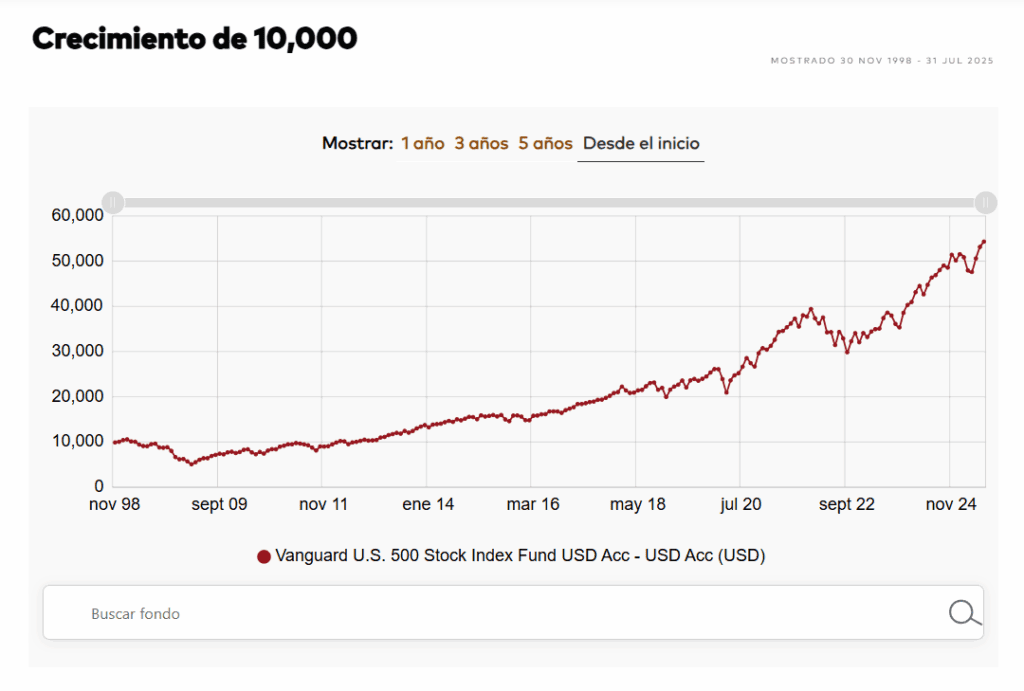

Vanguard US 500 Stock Index Fund

Vanguard is considered the pioneer in passive management. Its founder, John Bogle, was the creator of index funds, at least in terms of public perception. For this reason, Bogle is often called “the father of low-cost investing.”

Vanguard is a management company specialized in this investment philosophy and has extensive experience. One of its products is the Vanguard U.S. 500 Stock Index Fund.

As its name suggests, this fund is indexed to the S&P 500, thus replicating the performance of the U.S. stock market.

Over the last ten years, the net asset value grew by almost 13%, while its annualized return exceeded 13%. In the last five years, both figures surpassed 15%.

According to Vanguard, USD 10,000 invested in this index fund when it was launched in November 1998 would today be worth over USD 54,400.

iShares Bitcoin Trust

Launched in early 2024, the iShares Bitcoin Trust from BlackRock, the world’s largest asset manager, became one of the most popular index funds today.

Naturally, its performance is directly linked to the performance of Bitcoin, the most prominent cryptocurrency of the moment.

Today, this index fund in the form of an exchange-traded fund (ETF) has almost USD 90 billion in assets under management and has accumulated a 28% return in the past year.

The attraction of the fund lies in allowing less experienced investors in the cryptocurrency world to bet on the growth of this sector in a practical and simple way.

iShares Global Aggregate 1-5 Year Bond Index Fund

In this case, we are entering the world of global fixed income, showing that not all index funds replicate equity markets.

BlackRock also offers the iShares Global Aggregate 1-5 Year Bond Index Fund, which tracks the Bloomberg Barclays Global Aggregate 1-5 Year index.

This index measures the return of investment-grade fixed income assets maturing between 1 and 5 years, from both public and private issuers, including those from the securitization sector worldwide, denominated in various currencies.

Its annualized return over the past 3 years is 3.3%, and in the last year, it offered a 4.5% return.

Are there real estate index funds?

It’s important to note that there are also global real estate sector indices. Among them, the FTSE EPRA/NAREIT range stands out.

Real estate index funds can also be found, with the best example being the Amundi Index FTSE EPRA NAREIT Global AE-C.

Just like Bitcoin index funds, many real estate investment vehicles have an ETF structure.

Some examples could include:

- The Real Estate Select Sector SPDR Fund (XLRE)

- iShares US Property Yield (IDUP)

- Invesco Real Estate S&P US Select Sector (XRES)

Exchange-traded products represent a good alternative to structure real estate funds. They allow for agile trading, flexibility, and scalability, making them one of the most commonly used structures for investment vehicles.

After understanding what an index fund is, asset managers should know that they can improve liquidity through an asset securitization process, such as the one carried out by FlexFunds.

At FlexFunds, a company with over USD 6 billion in securitized assets and over 500 issuances in more than 30 countries, we transform liquid or illiquid assets into bankable assets with their own ISIN/CUSIP codes.

For more information about FlexFunds’ solutions and our asset securitization program, feel free to contact our team of specialists. We’ll be glad to help!

Sources:

- https://www.verifiedmarketreports.com/product/index-fund-market/

- https://www.ishares.com/uk/individual/en/products/290399/ishares-global-aggregate-1-5-year-bond-index-fund-ie?switchLocale=y&siteEntryPassthrough=true

- https://etfdb.com/themes/bitcoin-etfs/

- https://etfdb.com/compare/market-cap/

- https://www.home.saxo/learn/guides/diversification/index-funds-vs-actively-managed-funds-which-is-better-for-you