- This article explains what assetization and tokenization are, and how these processes differ.

- The information is aimed at investors, advisors, and asset managers seeking strategies to generate liquidity and improve diversification.

- FlexFunds offers an asset securitization program that falls under assetization. For more information, feel free to contact our experts.

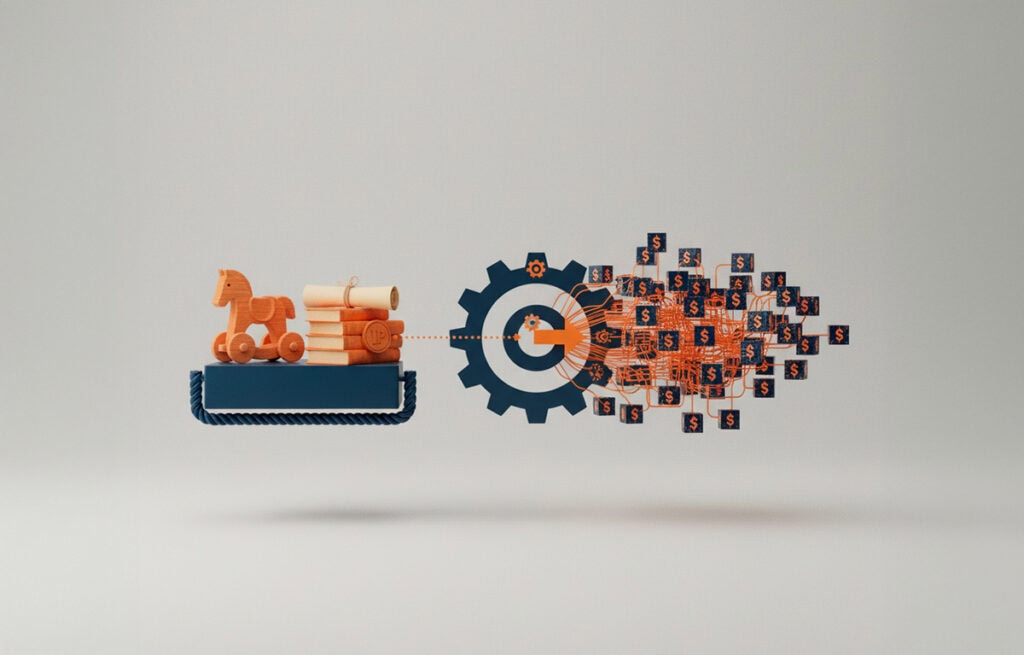

In recent times, two terms have emerged within the financial sector that have started to be used interchangeably: assetization and tokenization. However, these are two closely related mechanisms, but they are not the same.

What is assetization?

Assetization is the process of converting any good or economic flow into an investable asset. In practice, it consists of making traditionally illiquid sectors liquid. For example, sectors like livestock, art, intellectual property, or manufacturing can be transformed into accessible assets thanks to this mechanism.

Applications in established markets

Today, assetization is used in various sectors:

- Real estate: Tokens have been issued to fractionate properties. Some platforms allow investing in tokenized real estate projects with low amounts. This opens up the real estate market to smaller investors and improves the liquidity of assets that were previously only bought by large high-net-worth investors.

- Infrastructure and energy: Large projects (renewable energy, telecommunications, transportation) are financed through tokens. The actual income from these projects backs the value of each token. This channels global investment into public works or clean energy through digital assets.

- Commodities: Physical assets such as precious metals or commodities are tokenized to diversify portfolios. One ton of gold can be divided into thousands of tokens (one token per gram), allowing investors to buy minimal fractions. Similarly, energy resources (oil, gas) or carbon credits can be tokenized for easy inclusion in traditional portfolios.

- Other sectors: This includes art, luxury items, and agriculture. For example, some companies convert the operation of a livestock farm into a digital asset. In this case, the actual farm income is automatically distributed among the token holders via smart contracts.

Key benefits

Assetization offers key benefits for all parties involved in the operation:

- Enhanced liquidity: The fractionalization of large assets into tokens expands the secondary market. More investors can buy or sell small stakes, increasing the liquidity of previously illiquid assets.

- Access to capital: Issuing tokens opens up new global funding channels, as companies and projects can raise funds faster and cheaper than with conventional instruments by reaching investors worldwide in a digital form.

- Diversification: Additional asset classes emerge in portfolios (art, patents, tokenized agricultural goods, etc.), expanding investment options and helping distribute risk.

- Financial inclusion: By dividing expensive assets into very small units, the entry barriers are reduced. This way, investors with little capital can participate in various transactions, democratizing access to high-value investments.

What is a token?

A token is a digital certificate created on a blockchain that represents a right or asset. As explained by BBVA, “A token is a piece of code whose content grants a specific person a right” (e.g., ownership of an asset or access to a service). Tokens can be fungible (interchangeable with each other, such as cryptocurrencies like Bitcoin or Ethereum) or non-fungible (NFTs, where each token is unique).

Tokens only exist in digital environments based on blockchain and are used to securely trade securities, services, or assets.

Underlying technology

Tokens are supported by blockchain and smart contracts. Blockchain is a distributed and immutable ledger: every token movement is permanently and publicly recorded.

Thus, the blockchain acts as a source of truth, maintaining an unalterable transaction record. And since it is decentralized, it does not rely on a central authority, speeding up the validation of each transfer.

Smart contracts are self-executing programs on the blockchain that define the rules of the token (for example, the ERC-20 standard on Ethereum). These contracts establish how many tokens exist, how they are transferred, and under what conditions payments or rights are unlocked.

Advantages of tokenization

Tokenization specifically offers some key advantages:

- Fractionalization: A token allows dividing a valuable asset into very small units. Small investors can thus purchase a portion of a property, a ship, or a piece of art.

- Efficiency: By eliminating intermediaries (banks, notaries, traditional exchanges), transactions are faster and cheaper. Operations that used to take days or weeks can be completed in minutes using blockchain.

- Transparency Each operation is publicly recorded on the blockchain. This facilitates auditing and prevents fraud since any change of ownership of a token is visible and cannot be modified retroactively.

- Automation: Smart contracts integrate business logic. They can execute automatic payments (e.g., dividends) or condition transfers without human intervention, reducing errors and speeding up processes.

Differences between assetization and tokenization

Assetization and tokenization are closely related but not the same.

Assetization is a broad concept that encompasses any form of creating new investment assets from real resources. In contrast, tokenization is a specific method of assetization that always involves issuing digital tokens on a blockchain to represent those assets.

In other words, all tokenization is a form of assetization (it generates a digital asset), but not all assetization requires tokens or blockchain (for example, traditional mortgage securitization).

Both approaches share the goal of improving liquidity and access to capital, but tokenization adds the technological component of blockchain, which provides immediate transparency and automation—features that conventional assetization does not have on its own.

Implications for investment managers and issuers

For investment managers, these models expand the structuring opportunities and access to new asset classes. By fractionalizing assets, it is possible to enable the participation of different types of professional investors in markets previously reserved for large-scale operations. Furthermore, the nearly continuous trading of tokens across multiple jurisdictions helps improve the operational liquidity of certain digital instruments.

However, new risks exist. Tokens can be highly volatile and are subject to regulatory and security uncertainties.

Therefore, each initiative must strictly comply with applicable financial laws, including securities registration requirements, disclosure, and investor protection. This forces professional participants to carefully verify the regulatory framework and custodial mechanisms involved.

For issuers, assetizing or tokenizing an asset opens new funding channels. A company can issue security tokens or fractionalized assets to raise capital globally, more quickly than through traditional issuances.

However, this involves complying with strict regulations. For example, in certain regions, tokens representing financial securities must be registered, provide full information (prospectus), and apply KYC/AML controls.

Meanwhile, issuers must create clear legal structures (such as SPVs or trusts) to back the token with the real asset.

At FlexFunds, a leader in asset securitization and ETP issuance, processes that fall under assetization, specialists are available to provide guidance.

To learn more about our products, feel free to contact our executives. We will be glad to assist you.

Sources:

- https://www.unknowngravity.com/articulos/tokenizacion-regulada-vs-no-regulada-diferencias-clave-y-que-debes-saber

- https://www.ibm.com/es-es/think/topics/blockchain

- https://es.weforum.org/stories/2025/09/como-transformara-la-tokenizacion-de-activos-el-futuro-de-las-finanzas/

- https://www.imf.org/es/publications/fandd/issues/2022/09/making-sense-of-crypto-ravi-menon

- https://www.bbva.ch/blog/educacion-financiera/blockchain-to-go/leccion-6-tokenizacion-de-activos-la-maquina-cripto-empieza-a-funcionar.html

- https://www.coinbase.com/es-es/learn/crypto-glossary/what-are-real-world-assets-rwa

- https://www.chainup.com/es/blog/C%C3%B3mo-tokenizar-activos-f%C3%ADsicos/