During the economic challenges following the impact of the pandemic, portfolio managers are struggling to offer greater value to their clients when they are looking to optimize their costs.

Here are the top 5 changes portfolio managers are implementing to survive a challenging 2022, marked by inflation, escalating interest rates, and a supply crisis exacerbated by the war in Ukraine.

1-. Adaptability is key in times of uncertainty.

Fund managers have faced extended periods of volatility over the past two years in which the resilience and adaptability of their strategies were essential features to weather the challenges brought on by the pandemic, as analyzed by FlexFunds, a leading provider of asset securitization services.

As a result, fund managers have had to rethink their relationship with clients while offering more value to their portfolios and focusing on cost optimization in times of volatility when many investors are targeting safe-haven and higher-yielding assets.

Even after the pandemic, adaptability is an essential change in a scenario with new challenges for portfolio management, from rising inflation, which reached 8.3% year-on-year in April in the U.S., to escalating interest rates, which are now in the range of 0.75% to 1% in the U.S.

The consulting firm PwC indicates in its report Asset & Wealth Management Revolution that managers must be clear about their differentiating capabilities. They must back them up with strategic investments with a long-term vision and reorganize their commercial structure to optimize costs.

2-. Move fast, but be selective

In a competitive scenario and with more regulatory burdens, disconnecting from the reality of clients and their approach can cost portfolio managers dearly, who in the current circumstances of uncertainty and volatility must be aware of these needs and sharpen their sights so as not to miss the markets’ signals.

Managers today must be very selective about what to put in their portfolios. At a time of contrasts in which some baskets of commodities have rebounded in price, as in the case of oil, while technology firms are experiencing grey hours on Wall Street, weighed down by rising interest rates.

Having this insight is decisive in the current circumstances, which implies analyzing in detail which strategy is most required by your clients according to each manager’s risk profile and expertise. You can assume an analytical and more reserved stance through passive management or improve market returns with active management. Still, all this will depend on that critical vision to find opportunities and choose the best way to exploit them.

3-. Clients seek alternatives

One of the trends of this decade is a focus on thematic investments, as investors increasingly seek to take advantage of opportunities outside traditional assets.

This approach seeks to identify “the potential for structural change and invest in anticipated transformations (such as the rise of the Internet in the 1990s),” the U.S. investment management firm BlackRock explained.

This new wave of investors is driving changes in the structure of products and services for portfolio managers, who will increasingly have to become accustomed to the importance of digital assets and will no longer be able to dismiss them.

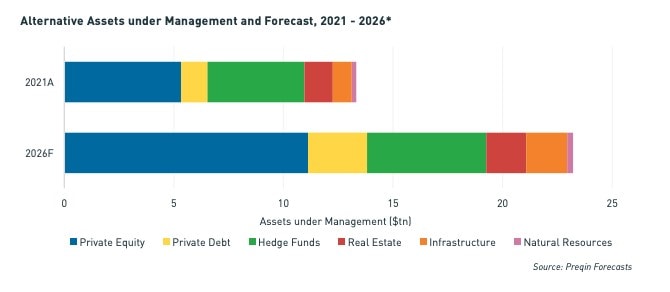

Figures from investment data platform Preqin show that alternative asset fund managers now have more than US$13 trillion in assets under management (AUM) globally. These funds will maintain growth until the end of 2026 when AUM is expected to stand at over US$23.21 trillion.

Preqin notes that 2021 was “a pivotal year in the history of alternative assets,” as “while governments and economies were still feeling the effects of the pandemic, private equity and hedge fund investments soared.”

4-. A digital experience is no longer an option: the pandemic marked the changes.

Just as this shift to new assets is gaining relevance, technological tools have become decisive for personalizing services, such as artificial intelligence or analytics, becoming more relevant to generate value in portfolios.

“Every company must become a technology business. Artificial intelligence, robotics, big data, and blockchain are transforming the industry. Technology will determine which companies are the winners in a rapidly changing landscape,” PwC explains in its report.

With the pandemic, portfolio managers had to adapt to new digital channels to maintain the daily dynamics with their clients. Hence, investments in that field eventually increased, and the user experience evolved into an environment where immediacy is the premise.

5-. The market is rapidly democratizing

The wave of digitalization allows greater access to options reserved for institutional and specialized investors.

According to McKinsey “this decade will see progress in what it has called the democratization of private markets from the supply and demand side.”

McKinsey forecasts in its report, titled Crossing the horizon: North American asset management in the 2020s, that there will be increasing numbers of investors and advisors looking for alternatives in those vehicles that are diversifying, innovating, and being constantly challenged by fintech offerings as investment options democratize.

“An asset class once reserved for large, sophisticated institutional investors is increasingly finding its way into individual portfolios,” McKinsey notes, prompting managers to diversify and customize their offerings as the spectrum broadens.