After widespread declines at the beginning of the pandemic, followed by a robust economic revival and a rapid recovery of the leading indices during 2021, the situation in 2022 has become complex for making investment decisions.

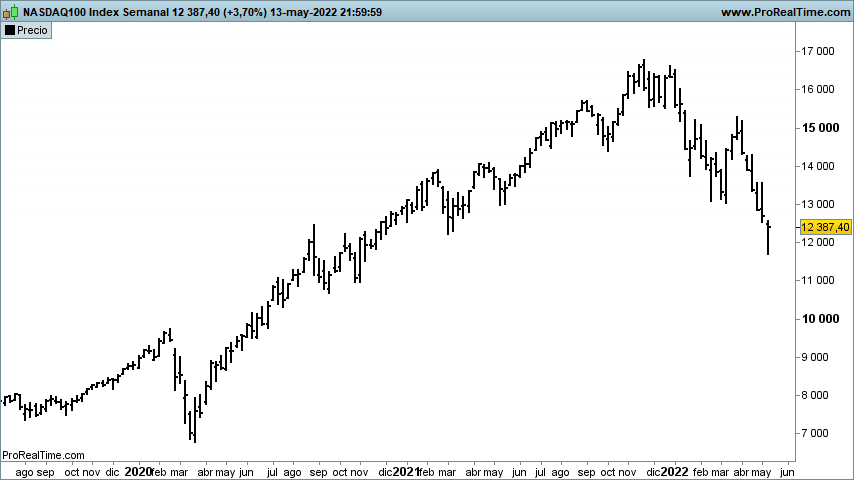

We are currently facing geopolitical problems caused by the conflict between Russia and Ukraine and other economic difficulties stemming mainly from inflation. This combination of elements is causing turbulence in the markets, both in fixed income (bonds) and equities (stocks). In the case of bonds, we can take as an example the correction of the Nasdaq 100 index, which comprises the 100 most important technology companies in the American market. By 2022, this index has accumulated declines of more than 25%.

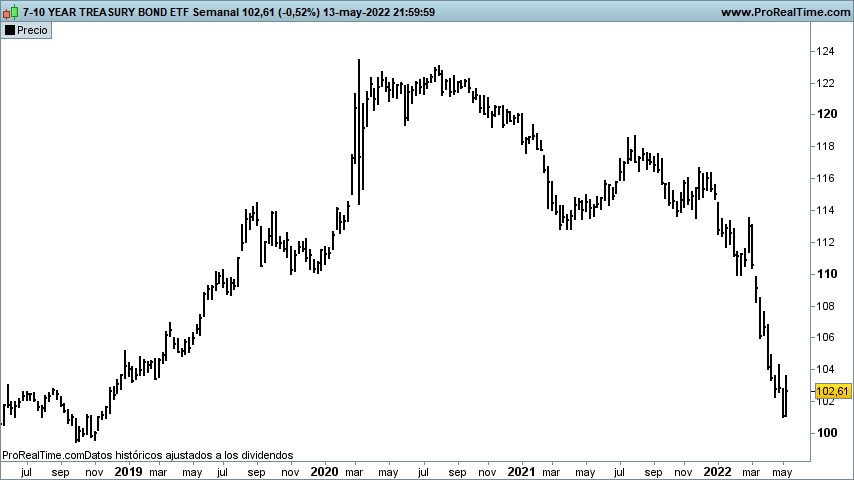

Meanwhile, as an example of fixed income, we can use the US seven to ten-year bond, which, since the highs in 2020, has accumulated declines of over 17%, with more pronounced falls during 2022.

Despite such unfavorable performance data, there are some exceptions in fixed-income and equity markets.

- In the case of equities, there are singularities, especially in companies and commodity-linked ETFs. Examples include the Invesco DB Commodity Index Tracking Fund ETF (one of the best ETFs for 2022) and companies such as the American oil company ExxonMobil or the Spanish cellulose producer Ence. In all cases with returns above 30% for this year.

- Within fixed income, we find good performance in covered bonds, generally issued by financial institutions backed by good quality mortgage loans, such as the Nordea-1 European Covered Bond Opportunities mutual fund, which, with relatively contained volatility, manages to avoid losses, and shows an appreciation of 1.5% this year.

As can be seen, despite the uncertain economic situation in 2022 and high inflation, a well-diversified portfolio may diminish the impact of market declines.

What investment vehicles can we find in 2022?

1.- Exchange-Traded Products (ETPs)

Exchange-traded products or ETPs are investment instruments that replicate the movement of financial assets such as a set of stocks, indices, currencies, or commodities. They also include exchange-traded funds or ETFs.

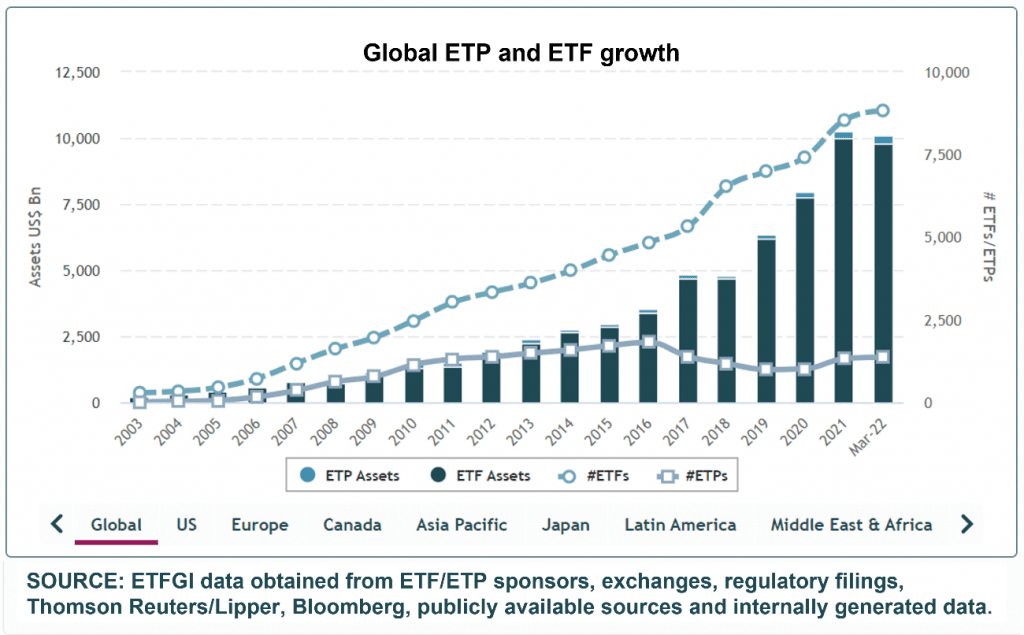

Global assets in ETF and ETP products reached a record $10.7 trillion in 2021. The 28.5% increase noted in 2021, compared to 2020, demonstrates the dynamics that this vehicle has registered throughout the year, according to figures from ETFGI (independent research and consulting firm).

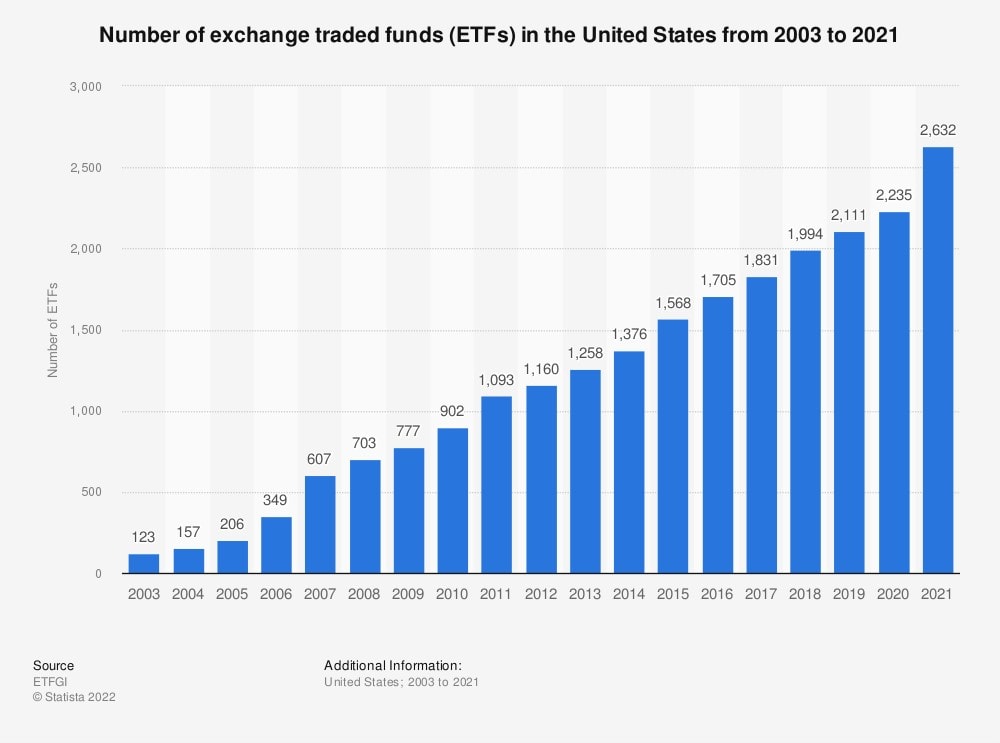

ETFs have increased their range of offerings within ETPs and are becoming more and more accessible. The following graph shows the number of ETFs traded in the United States, including 2021, where it is clear how their offer is increasing every year. For the above reasons, investors increasingly use ETFs in their investment strategies.

Among the most innovative ETFs to invest in, those related to the metaverse and blockchain stand out, where the catalog is becoming increasingly broader. Examples include Roundhill Ball Metaverse ETF (metaverse) or Invesco CoinShares Global Blockchain UCITS ETF Acc (blockchain).

The question now is: how to acquire an ETF? Through a financial intermediary. To choose one, it is necessary to consider the administrative costs, both in buying and selling.

2.- Investment in REITs

Within the world of alternative investments, defined as those investments that are in a certain way uncorrelated to the traditional markets, we have REITs (Real Estate Investment Trusts).

REITs are real estate investment trusts which invest in different assets in this sector and subsequently lease them. In this case, the cash flows generated by these companies come from the leased real estate.

The good thing about this type of company is that they allow access to the real estate market without the need to risk a large amount of capital. As a rule, they generate immediate liquidity in the event of needing it.

There are different types of REITs, and each of them specializes in a particular segment within the real estate sector. For example, there are SOCIMIs (Spanish real estate investment listed corporations) that specialize only in the rental of offices or the rental of parking spaces.

It is possible to access this type of investment through listed companies or through investment funds that invest in this type of firms.

Under these sorts of alternative investment, investors acquire a stake in a fund and entrust their resources to a management company that manages them professionally.

For more information on real estate investment possibilities, you can read our article on How to invest in real estate.

3.- Green bonds

Government and private initiatives to promote environmental projects have given rise to green bonds. These are instruments to finance plans related to clean energies, adaptation to climate change, conservation of water resources, or more sustainable mobility.

BNP Paribas’ Global Outlook 2022: Bullish – Selectively report states that green bond issuance could grow by 60% globally thanks to the more robust adoption of sustainability focus and ESG criteria expected this year.

According to figures released by Statista, the United States is the leading issuer of this type of bond in the world, with a value of US$37.59 billion, followed by Germany and France. The largest capital allocations of the money raised by green bonds went mainly to clean energy and sustainable construction projects.

To participate in the issuances of these bonds in a more diversified way, investors will need to do so through investment vehicles such as funds or ETFs. During this year, the performance of these investments has been quite negative, so investing in them requires caution and a long-term approach.

4.- Equity market

After the sharp falls of March 2020, the main markets recovered quickly and overcame pre-Covid levels without any difficulty. However, 2022 threatened to bring surprises, especially in Europe and the United States.

The central banks’ messages had begun to change, and inflation, which until a few months earlier had been “transitory,” according to the US Federal Reserve and the European Central Bank, was already becoming a problem.

With this message, the two institutions made it clear that they would act to alleviate inflation with specific measures, such as raising interest rates and halting bond purchase programs. These decisions suggest that turbulence in 2022 was beginning to look likely.

In February of this year, Russia decided to invade Ukraine, further complicating matters. Russia is one of the world’s largest producers of natural resources, and Ukraine is one of the largest agricultural producers globally.

This invasion has caused some raw materials, which were already overpriced, to rise, even more, endangering world economic growth, at least for this year.

Despite the falls in the major markets, investment opportunities are already beginning to arise in certain niches, such as digital security.

5.- Cryptoassets

Increasingly adopted around the world, cryptocurrencies experienced one of their best years in 2021, not only in terms of their appreciation but also in the great media impact they have had worldwide.

Cryptoassets became part of the portfolio of many global investors who are increasingly opting for segments that move millions of dollars, such as non-fungible tokens (NTF), which earned a space in the music and art industry.

Although digital currencies are the future, there are many questions, especially those related to legislation. In addition, it should be considered that, although large projects back cryptocurrencies, it is still a speculative market.