Exchange-traded products (ETPs) will be on the radar of investors looking to expand their portfolios with new options at a time when competition in financial markets is driving innovation as the economic recovery progresses.

ETPs that trade like stocks and replicate the returns of an underlying asset in the markets to generate profits are shaping up strongly in 2022. Investors have identified added value in them to circumvent current challenges in the world of finance, according to FlexFunds, a specialist in the creation and set up of investment vehicles.

Thus, according to the independent research and consulting firm ETFGI1, ETPs, including exchange-traded funds (ETFs), have accumulated net inflows of US$1.04 trillion so far this year. According to ETFGI, assets invested in the global ETF/ETP industry rose from US$9.50 trillion last September to US$9.98 trillion at the end of October, an increase of 5%.

The Swiss firm SIX Group2 notes that the demand for investment opportunities “is also reflected in the expansion of financial products by issuers.” In this regard, it cites the example of the Swiss stock exchange, which in the current year “has already welcomed ten new issuers in the ETF, ETP and structured products segments.”

Increased exposure to alternative assets

According to expert opinion, as global economies normalize following the impact of the pandemic, investors are expected to opt for exposure to alternative assets to maximize their returns and diversify their portfolios leveraged by new trends.

Exchange-traded products are a clear alternative on the horizon for investors in 2022, given that it allows them access to a universe of options ranging from tracking the performance of an index to commodities and even cryptocurrencies, as is already the case today.

An article by Natixis Investment Managers specialist Nicholas J. Elward3 indicates that “increased market volatility is driving some investors to seek actively managed ETFs. The reason is that they expect active managers to be better able to mitigate volatility and downside risk.“

Cryptoassets break into the world of ETPs.

By 2022, according to a report released by Natixis Investment Managers, cryptocurrency ETFs are projected to continue to gain traction after ProShares Bitcoin Strategy launched the first of its kind in the US at the end of October.

This ETF, which replicates the performance of bitcoin futures contracts, but does not invest directly in that cryptocurrency, paved the way for more exchange-traded funds to set up, as has already happened with Valkyrie Bitcoin Strategy.

Nowadays, it is estimated, the assets under management in the US by ETFs are around US$6.5 trillion, while the opportunity that the world of crypto assets opens up in this business is US$2 trillion and a universe of 200 million users4, according to CNBC.

Interest in the ETFs market is growing, as evidenced by the survey of Bitwise and ETF Trends cited by CNBC5, which concluded that “81% of all financial advisors reported receiving questions from clients about cryptocurrencies in 2020, up from 76% in 2019.”

On these findings, ETF Trends founder and CEO Tom Lydon stated that “financial advisors are increasingly seeking exposure to alternative assets and interest in cryptocurrencies is on the rise.”

Investor profile boosts a new paradigm.

Investment management firm BlackRock6 highlights that exchange-traded products, and especially ETFs, could gain more ground. They are “increasingly being used in portfolios to seek outcomes that differ from the overall market” while generating a “transformation in the financial advisory business model” and “an evolution in the way bond trading tends to favor ETFs for efficient market access.”

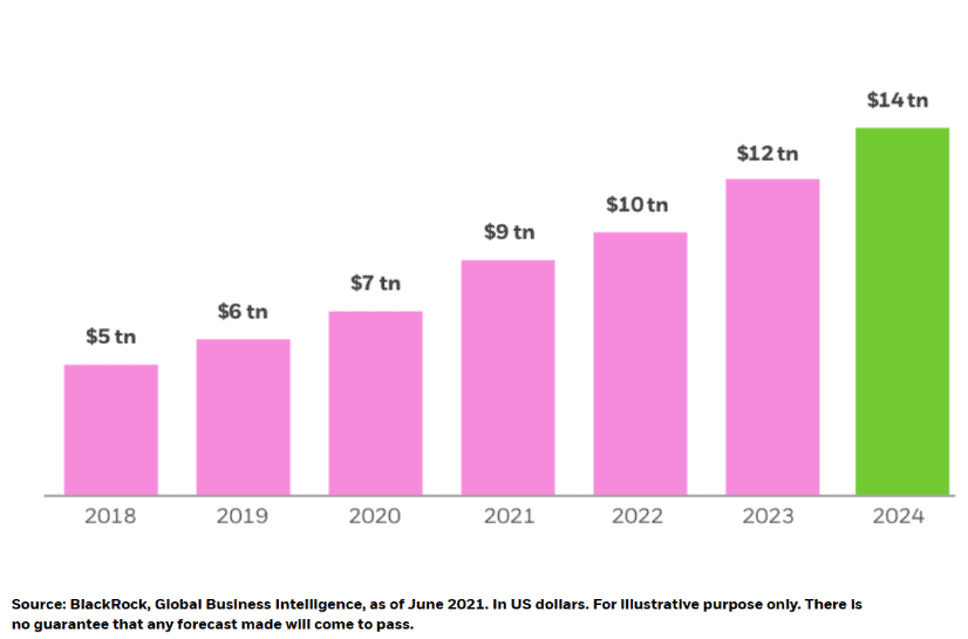

BlackRock further predicts that investors are going to increase the adoption of these instruments. However, it will remain “cost-sensitive” and thus demand quality more than ever, taking global ETF assets to US$14 trillion by the close of 2024. “We believe investors are poised to increase their use of ETF strategies as tools to beat the market in the coming years,” it emphasizes.

FlexFunds is uniquely positioned to provide asset management firms with turnkey or custom-built solutions that facilitate the setup and launch of ETPs, fund accounting, and corporate administration services. With over $1.5 billion under management and more than 250 issuances in over 30 countries, FlexFunds has supported financial institutions, hedge funds, investment advisors, fund managers, and real estate investment managers to enhance the distribution of their investment strategies, facilitating access to global investors. If you would like to learn more about our services, we invite you to arrange a personalized session with our financial experts to get started in the ETP space. Don’t hesitate to get in touch with us at www.flexfunds.com.

References

- ETFGI reports ETFs and ETPs listed globally have gathered over 1 trillion US dollars in net inflows in the first 10 months of 2021, November 10, 2021. www.etfgi.com

- 360° Perspectives on Indexing & Theme Investments, September 10, 2021. www.six-group.com

- 2022 ETF Trends to Watch, October 20, 2021. www.im.natixis.com

- This $20 trillion corner of investing could drive the lion’s share of crypto ETF demand, CEO says. October 30, 2021. www.cnbc.com

- Bitwise/ETF Trends Release Results Of 2021 Survey of Financial Advisor Attitudes Toward Crypto/ January 12, 2021. www. bitwiseinvestments.com

- 4 TRENDS DRIVING ETF GROWTH. June 2021. www.blackrock.com