We start off with a point of clarification: Over time, the term “Exchange-Traded Fund” (ETF) has tended to become a blanket term used in place of “Exchange-Traded Product” (ETP). While all of the former are the latter, it’s not the case the other way around.

All ETPs are financially engineered products benchmarked to myriad asset classes: stocks, bonds, commodities, real estate, etc. When designed in plain vanilla fashion around a large “basket” of stocks, bonds or specific commodities, they’re considered ETFs.

When the basket becomes smaller, adds special features such as leverage or short exposure, et al, they’re considered ETPs.

Hereafter, both ETFs and ETPs will be referred to as “ETPs” while the terminology used in the sources will remain untouched.

Why have ETPs become one of the best options for asset managers?

As we will see along these lines, since the first ETF began trading in 1993, exchange-traded products (ETPs) have evolved into increasingly sophisticated solutions, with greater advantages for the asset management industry and greater popularity among investors.

Investment in ETPs remains in uncertain times.

In addition to opting for flexibility in trading, efficiency in operating costs, and taxation, as volatility in the markets increases, investors are opting for investment vehicles that present transparency and liquidity.

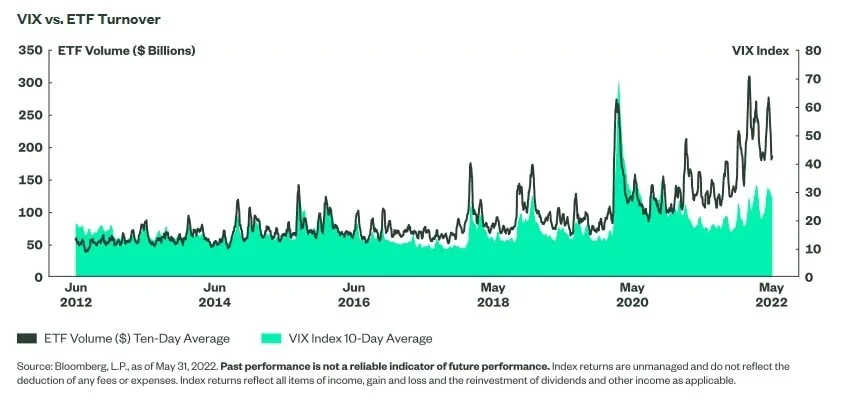

Trading volumes of ETPs in the United States show high correlations with the volatility index (VIX), as reflected in a report presented by State Street Global Advisors1.

In 2020, the correlation between the VIX index and the average 10-day trading volume in ETFs increased to 82%.

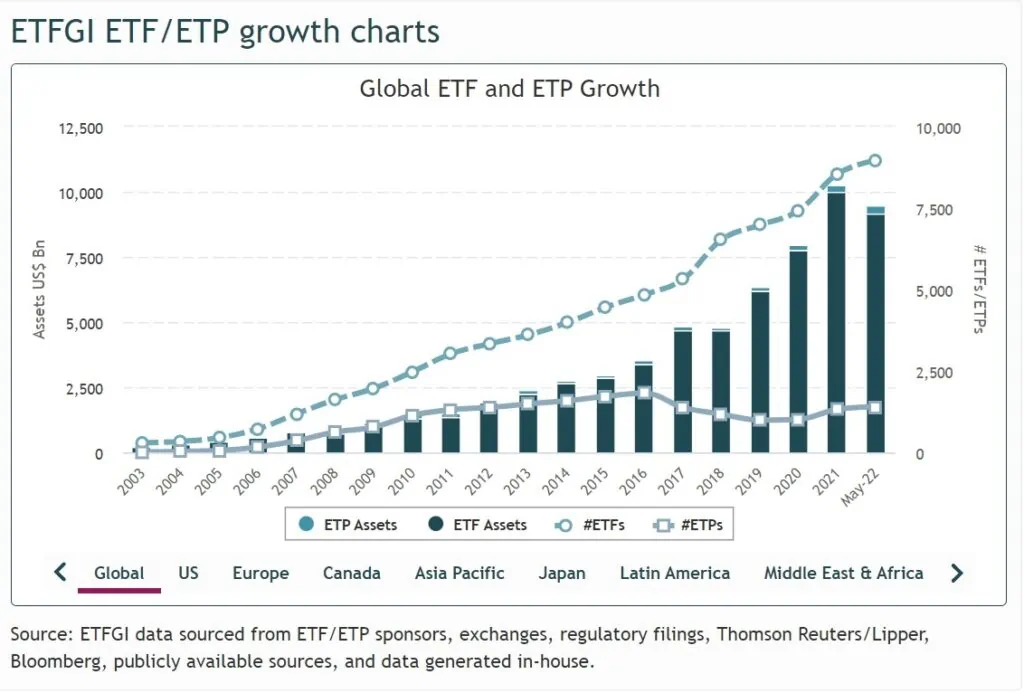

Deborah Fuhr, the founder of ETFGI, indicates that, in 2022, ETFs will continue to show the ability to attract capital despite market conditions and geopolitical risks2.

According to the growth chart published by this same ETP research and analysis house (ETFGI), in May 2022, the volume of assets under management of these products is close to reaching the figure for the whole of the previous year. If this trend continues, 2022 may represent a new record in the growth of these products.

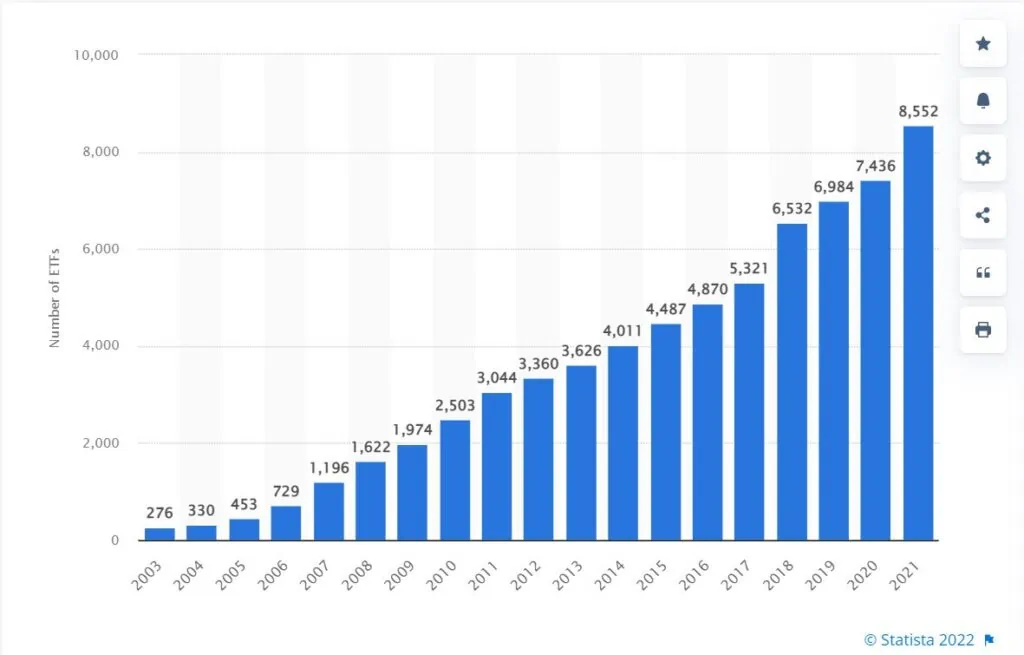

According to Statista, in 2021, there were already 8,552 ETFs worldwide, some 1,116 more than the previous year. It can be seen in the graph below how the number of ETFs issued has been increasing, from 276 in 2003.

Number of exchange traded funds (ETFs) worldwide from 2003 to 2021

Increased interest from retail investors.

One of the main reasons why asset managers should consider ETPs is a growing interest from retail investors.

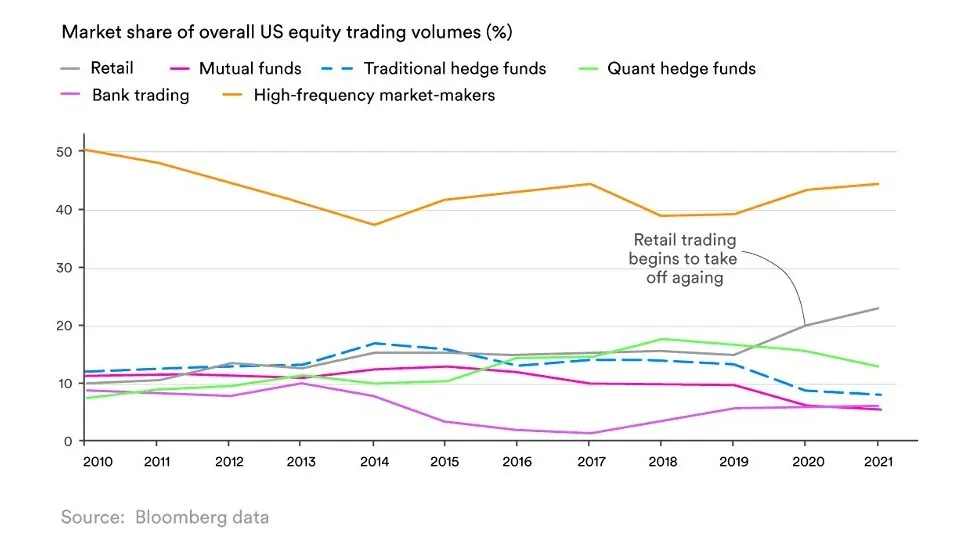

2020 also cemented the importance of retail investors who accounted for higher trading volumes than all others except high-frequency traders.

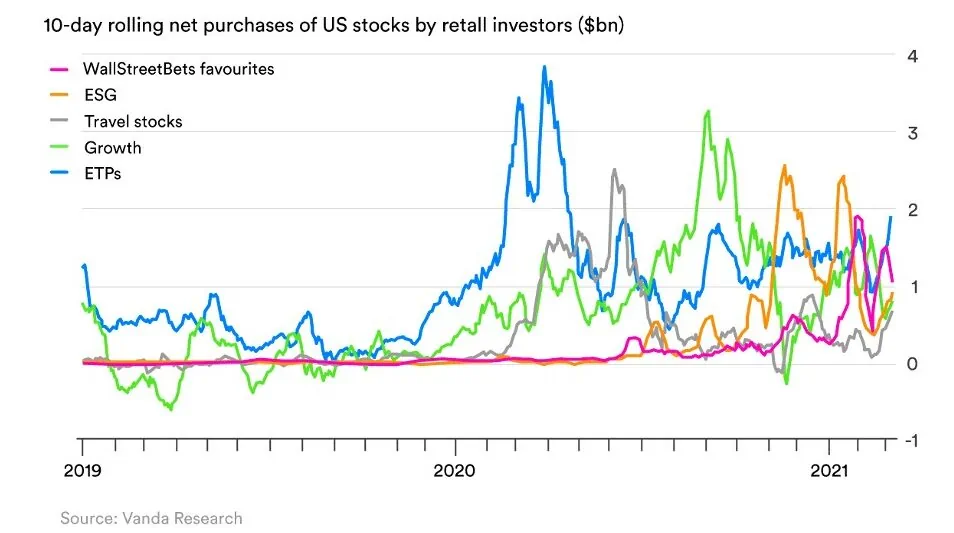

Contrary to popular media hype during the GameStop imbroglio, not all investors were focused on “meme” stocks; as per Vanda Research, March 2021 ended with retail investors taking a keen interest in the rich ETP space over all other categories:

This rise in interest in the ETP space is, by means, restricted just to the U.S. As per the World Federation of Exchanges, value and volumes of trades within this space in 2020 were up 42.3% and 73.6%, respectively, relative to 2019. In terms of number of trades, the EMEA region saw the highest increase (334%), followed by APAC (187.6%), and then the Americas (47.3%). The Americas, of course, remained the largest market in terms of trading activity with a 70.6% share.

This suggests a fascinating aspect of trend transference when it comes to trading preference: the U.S./Americas leads the pack, with EMEA and APAC following close behind.

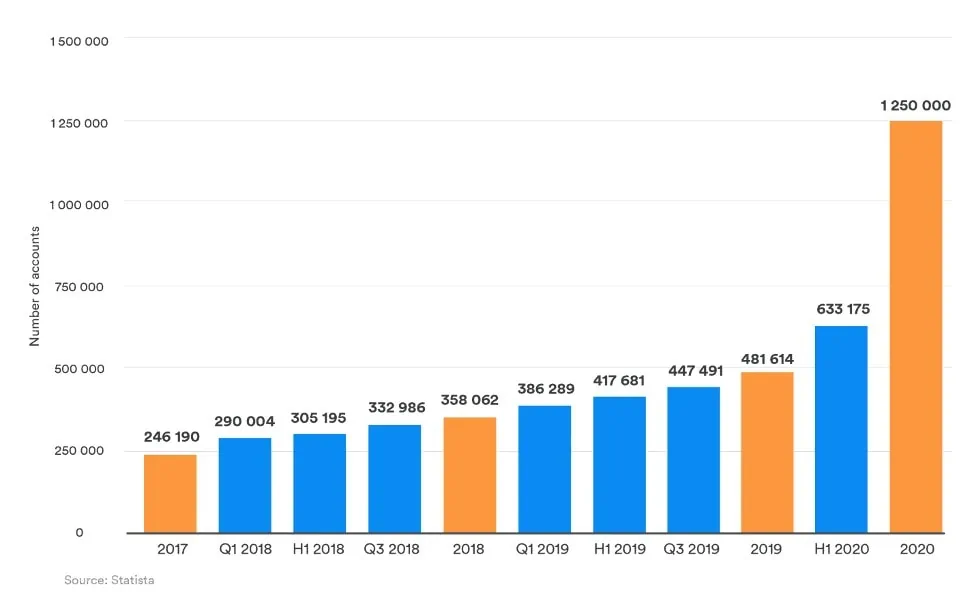

While analyzing European sentiment as a whole is a little more difficult – given the wide distribution of countries – some extrapolations can be made to support this idea. Statista estimates that popular online Dutch broker DeGiro – with a presence in 18 European countries – has registered a nearly 408% increase in online accounts from 2017 to the first half of 2020.

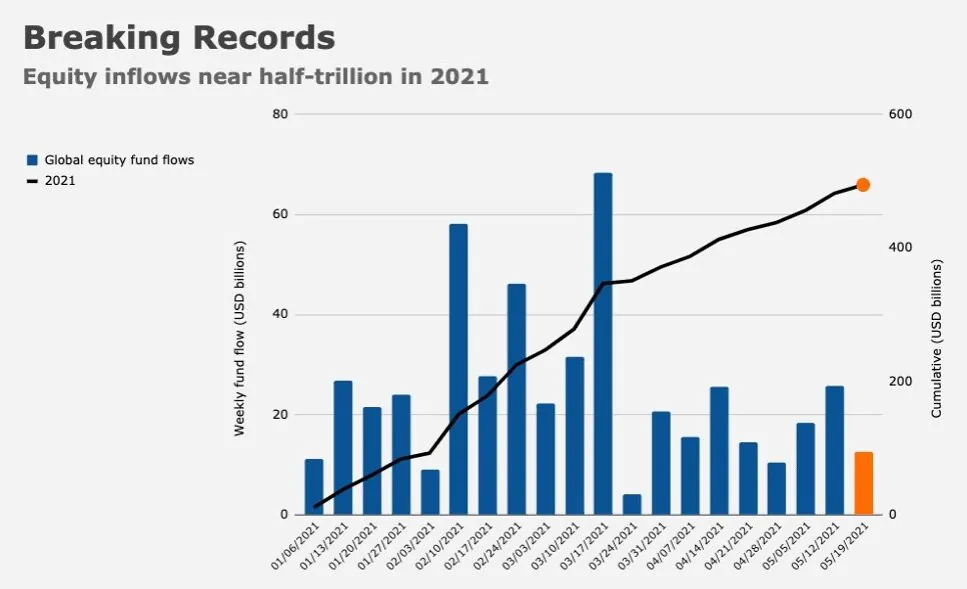

In one of May’s instalments of J.P. Morgan’s popular “Flows & Liquidity” series, Managing Director Nikolaos Panigirtzoglou asserted, “ETF flow has represented a wall of money backstopping each dip in equity markets so far this year” further illustrating the correlation with the chart below:

Panigirtzoglou says ETP behavior is driven “mostly by retail investors.”

Leadership of ETPs as investment vehicles.

By 2022, ETFs can become the leading financial instrument for investment, as highlighted at the Investing Trends event organized by brokerage firm XTB, which brought together representatives from some of the leading asset managers, such as JP Morgan, BlackRock, Amundi, Xtrackers, and Nextep Finance. They now account for 50% of total U.S. investment.

By May 2021, over half a trillion dollars in flow went to global equity funds. Around $388 billion of the $495 billion total is attributable to ETPs. Of that $388 billion, around $210 billion went to U.S. equity ETPs.

This behavior is perhaps unsurprising: retail investors “buying the dip” via ETPs is an efficient means of deploying a highly-liquid, risk- and cost-efficient investment strategy protected by the transparent and centralized framework of the exchanges.

Active management ETPs.

An ETP seems to bring to many a mind a “passive investment vehicle”, i.e. an instrument underlying an index with only periodic rebalancing and reconstitution. This is not quite true: With the rule’s changes by the SEC last year allowing for actively-managed ETFs (also known as “semi-transparent ETFs”), an increasing number of firms are moving into the ETP space by either converting mutual funds into ETPs as well as adding their own variations.

The rule change allows active fund managers to maintain their proprietary formulas, protect their research and change up their holdings as often as necessary. Actively-managed exchange-traded vehicles also get to offer the tax advantages offered to passive exchange-traded instruments.

A powerful example of this new type of investment vehicle would be the Cathie Woods-led Ark series. The company’s Ark Innovation ETF (ARKK) is currently quoted at around the US$ 45 with a 5-year annualized return of 24,45% (as of March 31,2022) while pursuing investments in companies poised to bring disruptive innovation.

Given high inflation in the U.S., real estate investments have been peaking in recent times. A few companies – including Janus Henderson, Fidelity Investments, SS&C ALPS Advisors and Invesco – have launched actively-managed REIT exchange-traded vehicles this year, thus increasing the number of avenues for retail investors to generate above-average returns.

Conclusion

For any asset manager, the time to go the ETP way is right now. With the continuing blossoming of the retail investor class and the explosion of outreach through online channels and media, the paradigm shift is investor segments and outreach is nearly complete.

In recognition of the need to nurture this space, Nasdaq’s Designated Liquidity Provider program is now giving market makers new incentives to provide liquidity in emergent ETFs. It is only a matter of time before such incentives are strengthened in EMEA and APAC.

FlexFunds is uniquely positioned to provide asset management firms with turnkey or custom-built solutions that facilitate the setup and launch of ETPs, fund accounting, and corporate administration services.

With over $1.5 billion under management and more than 250 issuances in over 30 countries, FlexFunds has supported financial institutions, hedge funds, investment advisors, fund managers, and real estate investment managers to enhance the distribution of their investment strategies, facilitating access to global investors.

If you would like to learn more about our services, we invite you to arrange a personalized session with our financial experts to get started in the ETP space.

Sources:

- “Market Volatility’s Back: Get In and Out with Liquid ETFs”, June 22, 2022, State Street Global Advisors.

- ETFs continue to attract capital despite tough market conditions, June 22, 2022, Reuters.

- “Retail investors keep buying the dip in ETFs”, June 27 2021, Financial Times

- “New Market-Maker Incentives Help Nasdaq Stoke ETF Liquidity”, September 16 2021, Nasdaq

- “Why the Popularity of ETFs is Good for Active Management”, October 13 2021, The Active ETF Channel

- https://www.fundssociety.com/es/noticias/etf/los-etfs-lideraran-el-crecimiento-entre-los-productos-de-inversion-en-2022-segun-las-grandes-gestoras

- https://ark-funds.com/funds/arkk/