- In this article, we outline the benefits of ETPs and explain why more asset managers are incorporating them into their investment strategies.

- It’s aimed at managers seeking to optimize their investment strategies through exchange-traded products.

- FlexFunds offers an asset securitization program to develop ETPs and support asset managers in streamlining their operations. To learn more, feel free to reach out to our experts.

Over time, the terms “exchange-traded fund” (ETF) and “exchange-traded product” (ETP) have often been used interchangeably. However, while all ETFs are ETPs, not all ETPs are ETFs.

ETPs are financial engineering instruments designed to track specific asset classes—such as equities, bonds, commodities, or real estate, among others.

When structured around a broad basket of stocks, bonds, or commodities, they’re generally classified as ETFs. However, when that basket is smaller or includes features like leverage or short exposure, they are considered ETPs.

For the purposes of this article, we’ll use “ETP” as an umbrella term for both ETFs and other exchange-traded products.

Why ETPs have become a top choice for asset managers?

Since the first ETP launched in 1993, these instruments have evolved into increasingly sophisticated solutions – delivering tangible benefits for the asset management industry and attracting growing interest from investors.

ETPs remain resilient during market uncertainty

In addition to offering trading flexibility, operational cost-efficiency, and tax advantages, ETPs are increasingly favored in times of market volatility for their transparency and liquidity.

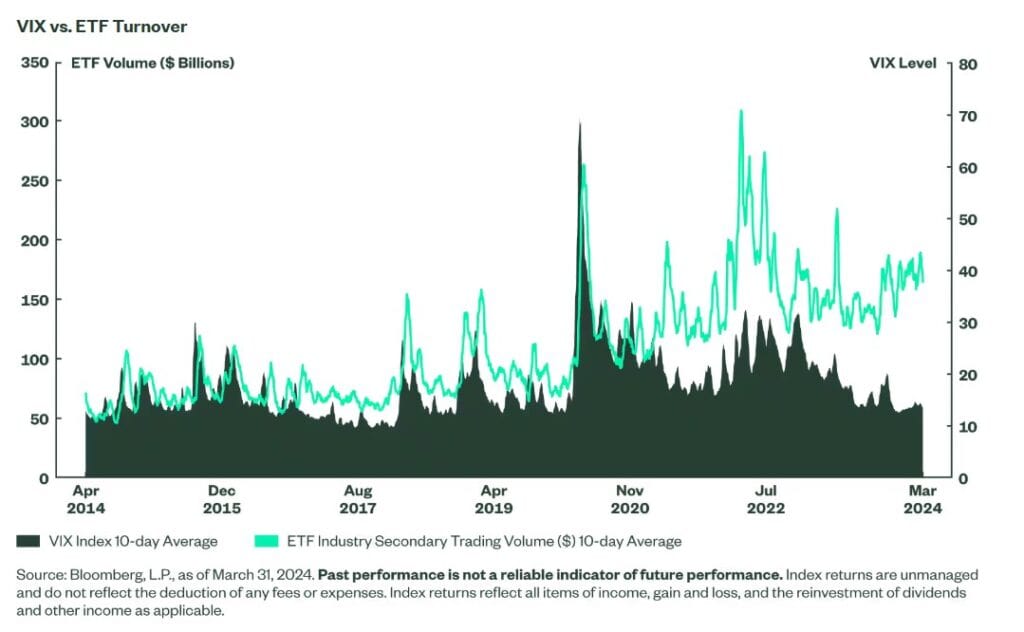

Trading volumes in U.S. ETPs have shown strong correlations with the volatility index (VIX), as highlighted in a report by State Street Global Advisors.

For example, during the highly volatile year of 2020 – marked by the COVID-19 pandemic – the correlation between the VIX and the 10-day average trading volume of ETPs reached 82%.

It’s no surprise, then, that these investment vehicles continue gaining traction. In fact, according to State Street, 2024 saw a record-breaking USD 1.9 trillion invested in ETPs – bringing total industry AUM to nearly USD 15 trillion.

“While it might seem challenging to top the record-breaking flows we saw in 2024, ETFs thrive when there are expectations of change, and we are continuing to see ETFs used to make directional portfolio shifts, both strategic and tactical,” noted Noel Archard, Global Head of ETFs and Portfolio Solutions at AllianceBernstein.

Rising interest among retail investors

Another key reason asset managers should consider ETPs is the growing demand from retail investors.

The importance of retail investors was also reinforced in 2020, as their trading volumes surpassed most other participants – except for high-frequency traders.

While the media spotlighted the “meme stock” craze, much of the retail investment actually flowed into ETPs. This trend has been one of the major growth drivers for the ETP industry in Europe.

According to EY, the European ETP market – which outpaced the U.S. market in growth in 2024 – is expected to reach USD 4.5 trillion in assets under management by 2030, driven largely by retail investor adoption.

“Although many providers are still relatively inexperienced in targeting retail investors, a combination of industry promotion, positive publicity and increasing accessibility are driving greater take-up of ETFs among European retail investors,” EY experts explained.

ETPs taking the lead as investment vehicles

Looking ahead, ETPs are expected to continue expanding and becoming dominant players in the global financial ecosystem – gradually taking market share from traditional mutual funds.

Why? Because investors increasingly prefer the liquidity and flexibility ETPs offer, prompting many asset managers to convert mutual funds into these exchange-traded vehicles.

According to Morningstar, the number of mutual funds converted into ETPs in 2024 was triple the figure seen in 2021. And Bank of America reports that roughly 400 mutual funds – representing over USD 325 billion in assets – are already poised for conversion in the coming years.

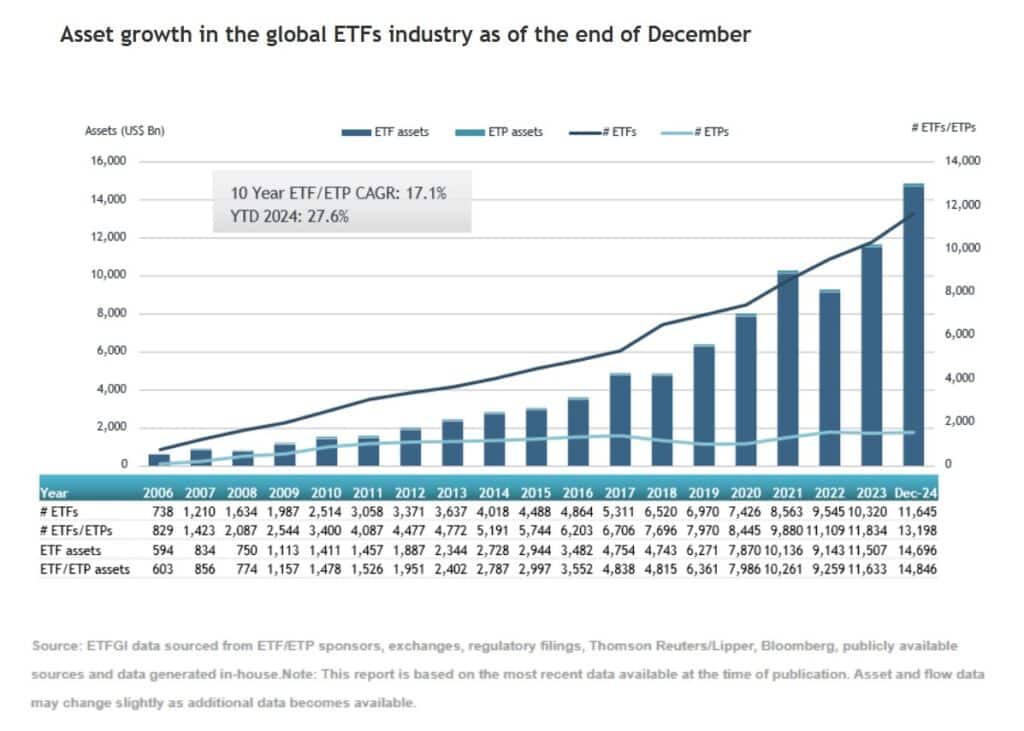

ETFGI reports that the global ETP industry grew from fewer than 2,000 products to over 12,000 by the end of 2024.

This rapid expansion reflects a shift in investor behavior. Many retail investors now “buy the dip” using ETPs as a liquid, risk-managed, and return-focused tool – enabled by transparent and centralized secondary markets.

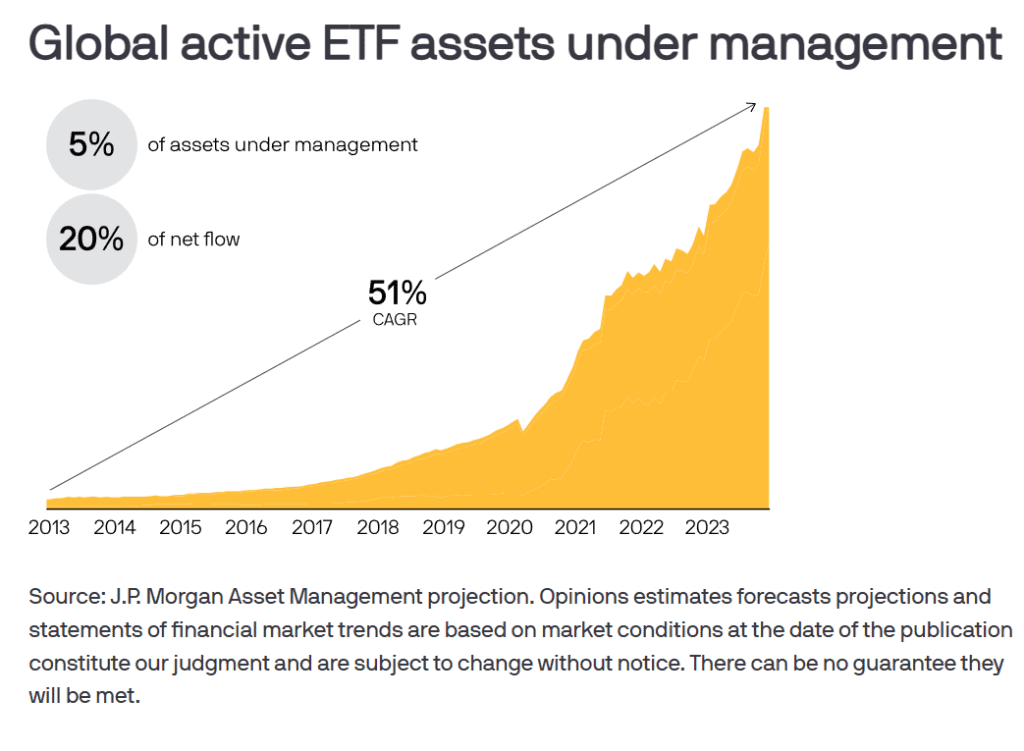

Actively managed ETPs

When people talk about an ETP, many associate it with a “passive investment vehicle” – that is, an instrument tied to an index, with only periodic rebalancing and reconstitution.

However, that’s not entirely accurate. Regulatory changes introduced by the SEC opened the door for actively managed ETPs. As a result, a growing number of firms have entered the ETP space, converting their active mutual funds into ETPs and incorporating their own variations.

These regulatory changes allow active fund managers to retain their strategies, protect their research, and adjust holdings as frequently as needed – within the new structure.

One of the key advantages is that actively managed exchange-traded vehicles can offer the same tax benefits as passive investment instruments.

One high-profile example is the ARK series led by Cathie Wood. The ARK Innovation ETF (ARKK) trades on the secondary market while targeting companies focused on disruptive innovation.

Other popular actively managed ETPs are found in the real estate sector – particularly relevant in a U.S. inflationary environment that remains unstable and may intensify due to trade tensions.

Within this group, standout real estate exchange-traded vehicles (REITs) include those offered by firms such as Janus Henderson, Fidelity Investments, SS&C ALPS Advisors, and Invesco.

Key benefits of ETPs for asset managers

Now is an opportune moment for asset managers to explore ETPs. With retail investors driving growth and digital media expanding awareness, a paradigm shift is underway across investor segments.

Given the need to support the growth of the ETP space, Nasdaq’s Designated Liquidity Provider Program is now offering new incentives to market makers to provide liquidity for emerging ETPs. It’s only a matter of time before similar incentives are strengthened in EMEA and APAC.

FlexFunds is uniquely positioned to support asset management firms with turnkey, customizable solutions. The company facilitates the creation and launch of ETPs, handles fund accounting, and manages corporate administration.

With over USD 1.5 billion in assets under service and more than 500 issuances across 30+ countries, FlexFunds has empowered financial institutions, investment advisors, hedge funds, and real estate fund managers to enhance the distribution of their strategies – expanding access to global investors.

If you’d like to learn more about our services, we invite you to schedule a personalized session with our financial experts to get started in the ETP space.

Sources:

- https://www.statestreet.com/ie/en/insights/etfs-2025-outlook

- https://www.ey.com/en_gl/insights/financial-services/emeia/how-etf-trends-are-shaping-market-growth-and-innovation-for-2025

- https://etfgi.com/news/press-releases/2025/01/etfgi-reports-global-etfs-industry-gathered-record-188-trillion-us

- https://www.investmentnews.com/etfs/mutual-fund-flips-to-etfs-hit-a-record-in-2024/258671

- https://www.ssga.com/us/en/intermediary/insights/market-volatilitys-back-get-in-and-out-with-liquid-etfs