- This article explains the key characteristics and advantages of ETFs and why they are gaining so much popularity.

- The information is intended for financial advisors and asset managers looking to build versatile strategies using exchange-traded funds.

- FlexFunds offers an asset securitization program to enhance the liquidity of many ETFs. For more information, don’t hesitate to reach out to our experts.

Among the vast array of investment options traded in the financial markets, ETFs have gained substantial popularity in recent decades. And the reason is simple: more and more advisors and managers are choosing to include them in their clients’ strategies. But what exactly are ETFs?

What is an ETF?

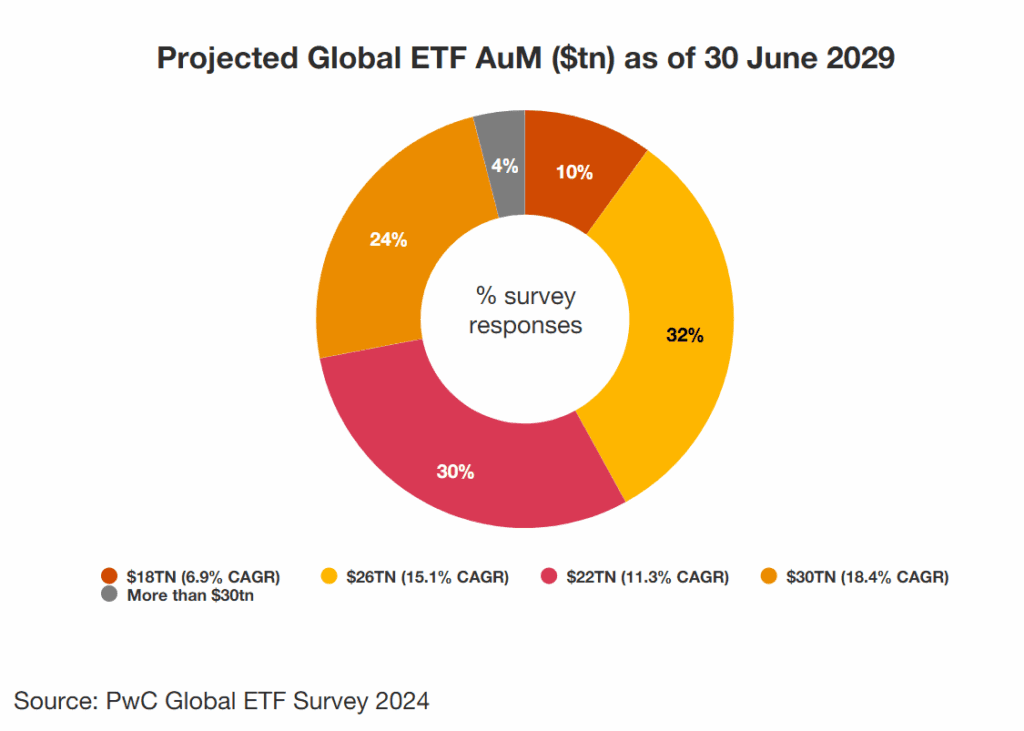

ETFs (exchange-traded funds) are a type of pooled investment vehicle managed by a third party that seeks to replicate the performance of underlying assets.According to PwC, in 2024, global ETF assets under management grew by a record 27%, reaching USD 14.6 trillion. Looking ahead, that number is expected to hit USD 30 trillion by 2029.

Part of this growth is due to the versatility of these financial instruments. Essentially, they are a blend of a mutual fund and a stock.

To understand what ETFs are, it’s important to note that they resemble mutual funds because they consist of different underlying assets. They are also similar to stocks because they are traded daily on secondary markets.

Driven by promising outlooks, more and more financial advisors are adopting ETFs and including them in the portfolios they design for clients, fueling a multi-billion-dollar business.

The fact that ETFs help diversify client portfolios and offer exposure to various indices or baskets of assets with transparency is what makes them so attractive to advisors.

Additionally, the broad distribution of ETFs allows investment advisors to offer their clients access to markets that might otherwise be difficult to enter.

Meanwhile, many ETFs allow investors to take positions on downward market movements, benefiting from declines in the underlying assets they aim to replicate.

Advantages of ETFs

From replicating indices like the S&P 500 on Wall Street to tracking the price of a commodity like gold, ETFs are structured in a way that allows them to be traded like stocks, offering liquidity to investors.

An investor can log into their brokerage account and buy or sell an ETF in just a few clicks—so long as the market is open.

Another key feature of this investment product is the transparency it offers, as all performance data is public and can be accessed in real time, as highlighted by BBVA Trader.

Moreover, asset managers, advisors, and investors can access a vast variety of ETFs.

There are not only equity ETFs but also ETFs based on bonds, financial derivatives, metals, agricultural commodities, indices, interest rates, and even volatility.

ETFs vs. Mutual funds

When discussing ETFs, it’s important to note the differences between them and traditional mutual funds.

The main feature of ETFs is their liquidity. Since they are traded on secondary markets like stocks, they can be bought or sold within seconds. In contrast, mutual funds have subscription and redemption periods that can take hours—or even days.

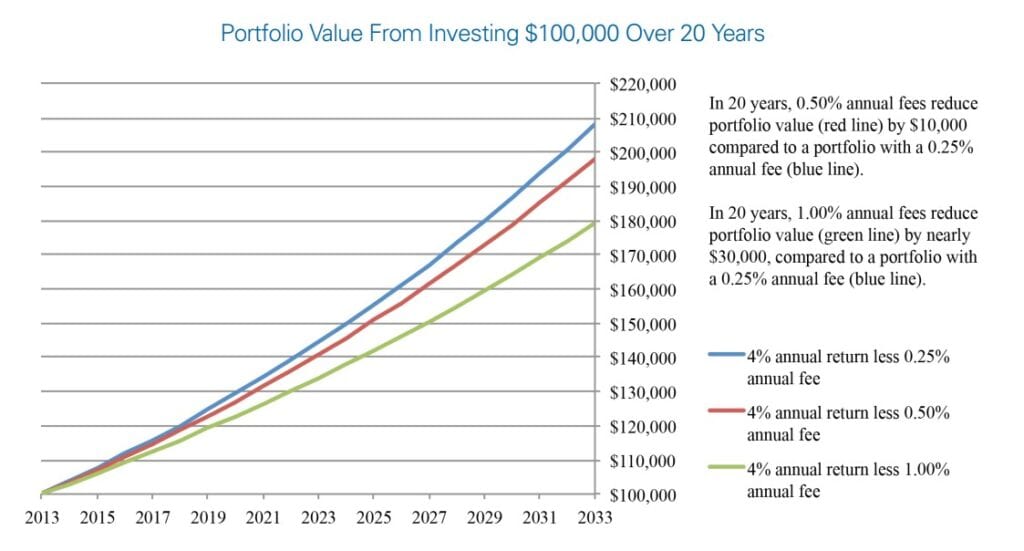

Additionally, ETFs generally carry lower fees, which can result in better real returns over the long term.

In fact, according to the U.S. Securities and Exchange Commission (SEC), assuming a 4% annual return over a 20-year horizon, a yearly fee of just 0.25% would result in a USD 10,000 loss on a USD 100,000 portfolio. In contrast, a 1% annual cost would lead to a USD 30,000 loss.

A high-potential option

According to a Citi report, there are several key trends shaping the ETF industry, which are driving more advisors to choose these financial instruments.

Market entry and differentiation

Although low-cost, market-cap-weighted ETFs have dominated in recent times, that may be changing.

Due to growing concerns about concentration in large U.S. corporations, advisors may begin shifting toward small-cap or equal-weighted funds.

Moreover, the industry is expected to evolve rapidly, potentially opening up new opportunities—especially outside the U.S. As a result, experts will need to manage ETFs tied to these emerging assets.

More focus on equities

Going forward, strong competition among asset managers will lead to a greater focus on equities, fixed income, balanced strategies, and convertible assets. This means that the dominance of traditional market-cap-weighted equity ETFs could decline in market share.

Adoption of new technologies

Lastly, according to PwC, one of the short-term growth drivers for ETFs will be the adoption of new technologies that streamline distribution.

“In turn, continued development of artificial intelligence (AI), blockchain-enabled tokenisation and other disruptive technologies could open new direct-to-investor channels and accelerate ETF democratisation,” explain PwC experts.

These strong outlooks are primarily supported by the fact that the ETF industry is evolving—both digitally and in terms of diversification. Its potential is expanding through non-traditional products such as thematic or crypto ETFs, pushing regulations to catch up with the pace of innovation.

It’s worth noting that regardless of the type of ETF selected by the asset manager, a securitization process—such as the one offered by FlexFunds—can be implemented to enhance distribution.

To learn more about FlexFunds’ solutions, don’t hesitate to contact our team of specialists. We’ll be glad to assist you!

Sources:

- https://www.pwc.com/gx/en/industries/financial-services/publications/etf-survey.html

- https://www.sec.gov/investor/alerts/ib_fees_expenses.pdf

- https://www.citigroup.com/global/insights/etf-perspectives-industry-outlook-a-roadmap-to-the-next-10-trillion