- This article analyzes recent years and the current state of the hedge fund market, characterized by high interest rates, inflation, and geopolitical instability.

- It is aimed at fund managers who manage hedge funds or those who want to understand the present situation of financial markets.

- At FlexFunds, we offer the possibility of securitizing a hedge fund, facilitating access to investors beyond your client base. Contact us for more information!

The global macroeconomic context has changed considerably in recent years, which has evidently impacted various investment vehicles and financial assets, such as hedge funds.

What are hedge funds?

Hedge funds are collective investment vehicles that typically employ aggressive management strategies to try to achieve the highest possible returns regardless of market conditions, whether the trend is up or down.

The hedge fund industry in recent years

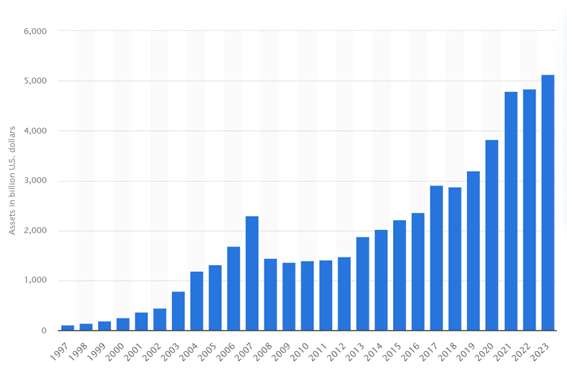

In recent years, the hedge fund industry has grown considerably. Specifically, its total assets under management (AUM) grew from USD 800 billion in 2003 to nearly USD 5 trillion in 2023, according to data from Statista.

And just last year, the top 20 hedge funds earned USD 67 billion in profits, compared to USD 65 billion during the stock market surge of 2021, according to LCH Investments. The figure is also three times higher than the USD 22.4 billion hedge funds earned in 2022.

Inflation and interest rates

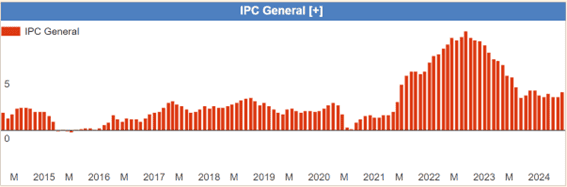

Currently, like the rest of the market segments, hedge funds are facing an uncertain economic environment characterized by persistent inflation and high interest rates.

According to the U.S. Bureau of Labor Statistics, the country’s March inflation was 3.5% year-on-year, lower than the 5.0% reached in March 2023 but higher than the 3.2% for February 2024. Additionally, the nation added 303,000 non-farm jobs in the third month of the year, far exceeding the 214,000 jobs expected by economists. Thus, the unemployment rate fell from 3.9% in February to 3.8%.

As a result, the Federal Reserve (Fed), which has a 2% inflation target, may delay interest rate cuts, which are currently in the range of 5.25%-5.50%.

“At this time, given the strength of the labor market and the progress on inflation so far, it is appropriate to give more time for restrictive policy to work and let the data and evolution of the outlook guide us,” said Jerome Powell, Fed Chairman, during a forum in Washington.

In this context, Morgan Stanley concluded: “We believe we are in a structurally different era for absolute return investment, and we doubt that inflation, interest rates, and volatility will return completely to pre-COVID-19 levels in the short or medium term.”

Geopolitical conflicts

On the other hand, global geopolitical instability seems far from over. In addition to the war between Russia and Ukraine that began in early 2022, fund managers are very attentive to what is happening in the Middle East.

“Nerves seem to be subdued for now given the nature of events and Iran’s de-escalation statements, but uncertainty persists,” reported JP Morgan analysts Madison Faller and Matthew Landon.

“Funds are also increasingly focusing on geopolitical risk, which encompasses not only military conflicts and the potential for expansion or the emergence of new conflicts but also upcoming elections,” mentioned Kenneth Heinz, president of Hedge Fund Research.

The arrival of cryptocurrencies

Meanwhile, during 2024, there was also an update regarding the union of conventional finance and cryptocurrencies, as the Securities and Exchange Commission (SEC) approved spot bitcoin exchange-traded funds (ETFs).

Just in March, these new investment vehicles captured over USD 110 billion in trading volume, three times more than in January and February. The total was led by BlackRock’s iShares Bitcoin Trust (IBIT), which accounted for almost 50%, according to Bloomberg Intelligence analyst Eric Balchunas. Thus, hedge funds were able to start adding bitcoin to their strategies, enhancing diversification and providing access to a high-growth industry.

The future of hedge funds

Despite the current volatility in financial markets, hedge funds will continue to provide adequate protection for their investors, especially those focused on equities.

“We expect long/short equity hedge funds (ELS) to outperform the industry’s long-term average in 2024, due to the significant increase in short-term redemptions and economic conditions within major geographic regions. We believe this will support generalist strategies and U.S. sector specialists, as well as regionally focused ELS funds in Europe and Asia,” said Joe Marenda, head of hedge fund research at Cambridge Associates.

Looking ahead to the coming years, the outlook is also optimistic. A Research and Markets report forecasted that the value of their AUM will enjoy a compound annual growth rate of 3.14% from 2024 to 2029. Of the total, the portion allocated to digital assets will rise from 26% in 2024 to 44% in 2028.FlexFunds offers the opportunity to securitize hedge funds in half the time and cost of any other market alternative, boosting their distribution capacity on international private banking platforms and facilitating access to non-U.S. investors. Would you like to explore this possibility in more detail? Feel free to contact our team of experts!