- Modern securitization and ETPs transform various asset types, including real estate and alternative assets, into bankable assets. These are assets distributed across global private banking platforms.

- Asset managers, financial advisors, and institutional investors who want faster, cost-effective access to international markets through custom investment vehicles can benefit from transforming ETPs into bankable assets.

- FlexFunds simplifies the process of setting up investment vehicles, transforming assets into bankable assets. Contact us today to learn how to start structuring your investments.

Modern securitization and repackaging strategies are useful means of accessing multiple private banking channels. This helps to transform various asset types into bankable assets, which can be distributed across private banking platforms.

Through securitization, both liquid and illiquid assets, like real estate, for example, can be converted into securities.

When combined with exchange-traded products (ETPs), this process allows for bankable assets.

Investment Strategies for Global Distribution

The conversion process is complex; however, FlexFunds specializes in simplifying this transformation.

As a result, we are leaders in providing investment vehicle structuring and administration. We create independent, fund-like vehicles called Flex.

Specifically, it’s designed for strategy management and global distribution to non-U.S. investors.

Moreover, these exchange-listed products give access to private banking platforms worldwide.

What Types of Assets Can be Converted into Bankable Assets?

FlexFunds’ investment vehicles are highly versatile. It’s not limited to a specific asset type. Accommodating a broad spectrum of assets, including liquid, illiquid, listed, and alternative investments.

Because private banks treat these transactions as debt, FlexFunds’ ETPs can access their distribution platforms faster. Consequently, this simplified process provides a major advantage over traditional funds, which, in contrast, usually can suffer from long delays due to complex verification and lengthy due diligence requirements.

What Is the Conversion Process?

Converting assets into bankable assets through an ETP is straightforward for our clients. Specifically, FlexFunds takes care of the ETP issuance process, corporate administration services, and fund accounting, making the ETP ready within six to eight weeks.

Then, once the entire process is completed, the advisor can market this product, which has brought together several assets, in a single investment vehicle.

In just five simple steps, any given client can launch their ETP, facilitating access to investors in the global capital markets.

5 Steps for Launching Your ETP

- Design the investment strategy of the ETP.

- Sign the Engagement Letter.

- Due Diligence.

- Creation of the ETP.

- Issuance of the ETP.

What Are ETPs and Where Are They Headed?

Exchange-traded products (ETPs) are investment vehicles that track the performance of underlying assets such as stocks, bonds, commodities, or indices.

They are traded on public exchanges just like individual stocks. This means that their prices fluctuate throughout the trading day as per daily market activity.

ETPs vs. Traditional Investment Funds

What makes ETPs stand out compared to other investment funds is their transparency, liquidity, and lower fees compared to traditional actively managed mutual funds. Moreover, as ETPs typically follow a passive investment strategy, they have fewer management costs. Therefore, this structure has made ETPs appealing to institutional and retail investors.

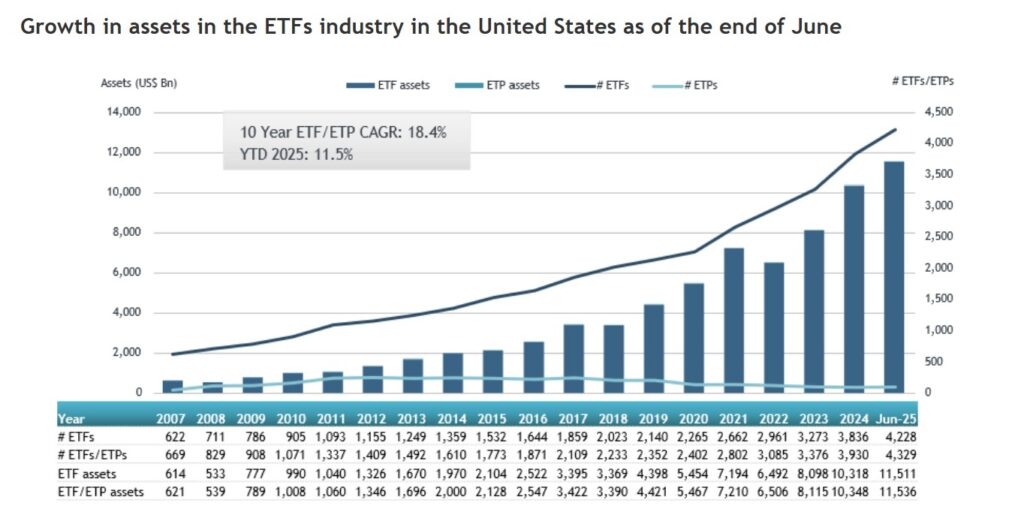

Since the launch of the first exchange-traded fund (ETF) in the U.S., the SPDR S&P 500 ETF Trust (SPY) in 1993, the ETP market has grown quickly. ETPs have become much more recognized as bankable assets.

Did You Know?

BlackRock projects active ETF assets will hit $4 trillion by 2030.ETFGI (an independent ETF and ETP research and advisory firm) claims that U.S. ETF and ETP assets reached a record high of $11.54 trillion at the end of June 2025, surpassing the previous peak of $11.04 trillion from May.

Bankable Asset Trends for the Upcoming Year

ETPs are being transformed by technological innovation and custom-built investment solutions. Essentially, forms of wealth that are not typically held in traditional financial accounts, like real estate, private equity, or digital assets.

According to Accenture’s 2025 report on asset management trends, the main focus for firms should be on creating custom investment products. These are usually built by private asset managers, providing custom strategies listed on exchanges. As a result, this makes it easier for investors to access specific market opportunities.

Meanwhile, the rise of AI and autonomous learning tools is allowing managers to get more insights from data and deliver better solutions to their clients.

Key Takeaways for Bankable Assets

- Customization is vital: ETPs are converting into useful tools for custom investment strategies.

- AI-powered tools are shaping fund design and performance analytics.

- Bankable assets are expanding to include digital and alternative investments.

- Budget-focused investors prefer clear, low-cost passive strategies, like ETFs.

For custom investment vehicles, FlexFunds offers the tools needed to quickly and efficiently provide innovative strategies to the market.

Contact FlexFunds today, and a dedicated member of our team will be pleased to help you.

Sources:

- https://www.marketwatch.com/story/why-blackrock-sees-active-etfs-more-than-quadrupling-to-4-trillion-by-2030-e56d53f6

- https://etfgi.com/news/press-releases/2025/07/etfgi-reports-assets-invested-etfs-industry-united-states-reached-new

- https://www.accenture.com/content/dam/accenture/final/a-com-migration/pdf/pdf-154/accenture-future-of-asset-management-executive-summary.pdf