- The securitization process enables investment managers, real estate companies, portfolio managers, and many other participants in the capital markets to repack and distribute liquid and illiquid assets in the form of listed securities.

- Ready to unlock the full potential of your strategy through securitization? Here, we will share some key factors to consider when aiming to securitize an asset.

- FlexFunds coordinates asset repackaging programs that help you bring to market any investment strategy. Contact our team to find out which solution suits your needs.

When looking to bring an investment strategy to exchange-traded venues, there are different factors to consider. When asset repackaging was introduced to the financial industry, it was initially utilized to distribute plain vanilla investment strategies. However, the market and the process have evolved; nowadays the securitization of assets can be implemented into any investment.

The securitization of assets creates liquidity for the originators (e.g., asset managers looking to generate Alpha while expanding the reach of their client base). It provides the investors who purchase the traded product a chance to invest in opportunities that would not be available in other circumstances, turning any asset, even illiquid one such as real estate, liquid.

A securitized investment yields its returns based on the income generated from the underlying asset(s).

In a succinct summary, the securitization process develops in two main phases:

- The assets originator defines the underlying to be “transferred” to the issuer. The issuer is often a Special Purpose Vehicle (SPV) that creates a tradable security, which can take the form of an Exchange Traded Product (ETP), Actively Managed Certificate (AMC), or Collateralized Debt Obligation (CDO), among others1. According to the 1st Annual Report of the Asset Securitization Sector, gathering the input of 80+ asset management companies from more than 15 countries, conventional investment funds, FlexFunds-type ETPs, and UCITs account for approximately 85% of the preferred structures for collective investment management.

- Once the SPV issues the negotiable instrument, this is subscribed by investors in a primary market. After that, they become available in the secondary marketplace1.

The primary market is where the issuers offer new investments. Then, buyers and sellers trade them in secondary markets.

FlexFunds offers tailored solutions for diverse asset classes. The product range also caters to various investment strategies. Listed securities can be repackaged through the FlexPortfolio, while existing traditional funds can leverage the FlexFeeder for additional distribution. For alternative investments such as REITs or real estate, the Flex Private Program provides an ideal solution.

Knowing the intricacies of the process is crucial to making well-informed decisions. To help you better understand the mechanism and its potential implications, we’ve compiled a detailed list of the key factors to consider when securitizing an asset.

- Transparent Fees

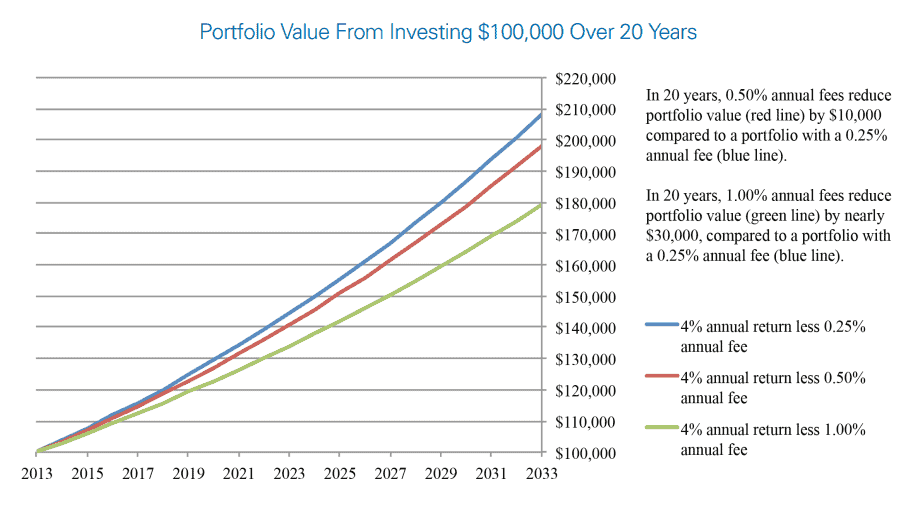

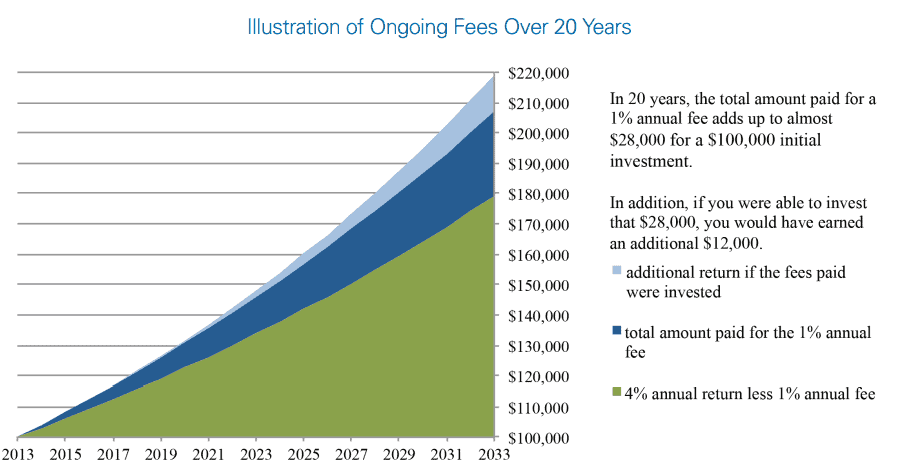

In some cases, the provider of the investment vehicle, such as Actively Managed Certificates (AMC), may charge some fees not necessarily disclosed at the beginning of the sales process, these fees end up reducing the Alpha obtained by the client (originator) and the returns for the investors. That’s why having a clear path and a well-defined fees and expenses structure is essential before issuing a securitized product. At FlexFunds, we strive to offer efficient investment vehicles with setup and maintenance costs that could be less than half of the industry’s other alternatives.

Beware of hidden fees and high maintenance costs. They can significantly erode the value of the investment, especially over time. These fees not only eat into your Assets Under Management (AUM) but also reduce any potential return the investor may earn2. Remember, the fee structure of your chosen investment vehicle can have a dramatic impact on your portfolio’s overall size and performance.

- Distribution and Pricing of the Securities

Whether an instrument is trading in an exchange or over the counter (OTC), it must be available for clearing, settlement, and custody. Euroclear and Clearstream enable the clearing and settlement of different asset class products, fulfilling a significant function in the securitization process; these Central Securities Depositories (CSDs) allow the efficient and secure distribution of market transactions, ensuring their integrity and validity. Once investors hold these securities in their respective custody accounts, they must be priced so investors can track their Profit and Loss (P&L) in the investment. Bloomberg, Refinitiv, and SIX Financial are the leading service providers for pricing data in the international capital markets, each of them being fundamental for the different custodians and brokers.

FlexFunds enhances distribution and pricing for all repackaged products issued under our program. Unlike some Actively Managed Certificates (AMCs) or UCITs, we ensure wider dissemination through data publication on Bloomberg, Refinitiv, and SIX Financial. Additionally, all the securities issued under our program are clearable in both Euroclear and Clearstream, expanding investors reach and price transparency.

- Renowned Issue and Paying Agent

One of the main actors in the securitization process is the Issuing and Paying Agent: the entity responsible for generating a unique identifier (ISIN) for the tradable security and ensuring timely and accurate distribution of dividends, coupons, and principal payments to investors on behalf of the issuer3. This essential role demands operating efficiency and partnering with a recognized provider who guarantees a seamless and streamlined journey throughout your securitized asset’s pre-issuance and post-issuance stages. All the above elements are covered in the FlexFunds’ Program by the Bank of New York Mellon.

FlexFunds specializes in the securitization of assets, being a leader in the industry that complies with the highest standards and state-of-the-art processes. To learn more about FlexFunds’ solutions, you can contact us to schedule a meeting and explore which of our solutions best suits you.

Sources:

- 1 https://smartasset.com/investing/securitization

- 2https://www.sec.gov/investor/alerts/ib_fees_expenses.pdf

- 3https://www.investopedia.com/terms/p/payingagent.asp#:~:text=A%20paying%20agent%20accepts%20payments,with%20debt%20instruments%2C%20like%20bonds.