- This article explains the main benefits of securitized bonds in real estate projects for fund and asset managers, such as diversification and liquidity.

- The content is aimed at fund managers looking to build strategies beyond traditional bonds and equities.

- FlexFunds offers an asset securitization program to develop securitized bonds and improve liquidity in investment strategies. For more information, feel free to contact our experts.

Regardless of global macroeconomic conditions, the real estate market remains one of the world’s largest and most important sectors. One of the key challenges faced by real estate developers working on large-scale projects is securing significant capital. Traditional financing methods like bank loans often fail to provide the flexibility or volume required.

Fortunately, one of the standout solutions is securitized bonds—frequently acquired by fund managers handling large capital allocations due to the multiple benefits they offer.

The Importance of securitized bonds

Securitized bonds are debt financial instruments backed by a specific pool of underlying assets.

In real estate, these assets can include mortgage loans, rental income-generating properties, or undervalued or under-construction real estate expected to appreciate over time.

The bonds are structured through a securitization process carried out by companies like FlexFunds, which transforms the asset portfolio into bankable assets. That is, securities with their own ISIN/CUSIP codes that can be easily acquired through existing brokerage accounts via Euroclear.

In this way, securitized bonds provide four major advantages for managers.

Diversification

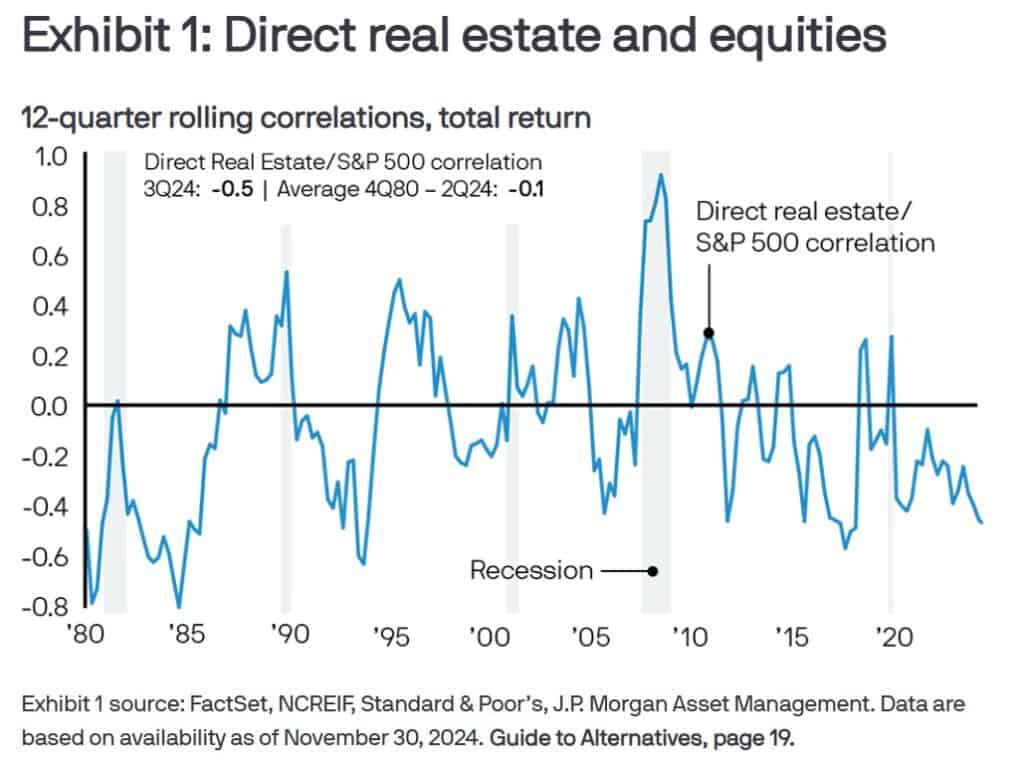

Asset managers can build more diversified strategies, since real estate-backed securitized bonds—being composed of real estate—tend to have lower correlation with traditional bonds and equities.

For instance, according to JP Morgan Asset Management, real estate has historically shown low or even negative correlation with the S&P 500. Moreover, although correlations between both asset classes tend to converge during recessions, they typically reverse quickly and decisively.

Considering these characteristics, a group of experts conducted in-depth research using 40 years of data, published in the Journal of Risk and Financial Management, reaching some notable conclusions.

Specifically, the study found that adding domestic and foreign real estate to a portfolio significantly improves its risk-return profile. U.S. and international real estate assets showed correlations of 0.65 and 0.57, respectively, with U.S. equities.

Additionally, the study compared three portfolio configurations and found that the most diversified—featuring international real estate—delivered the best results. This portfolio reduced risk, lowering standard deviation from 15% to 10.3%, and increased maximum return from 12% to 17.2% annually.

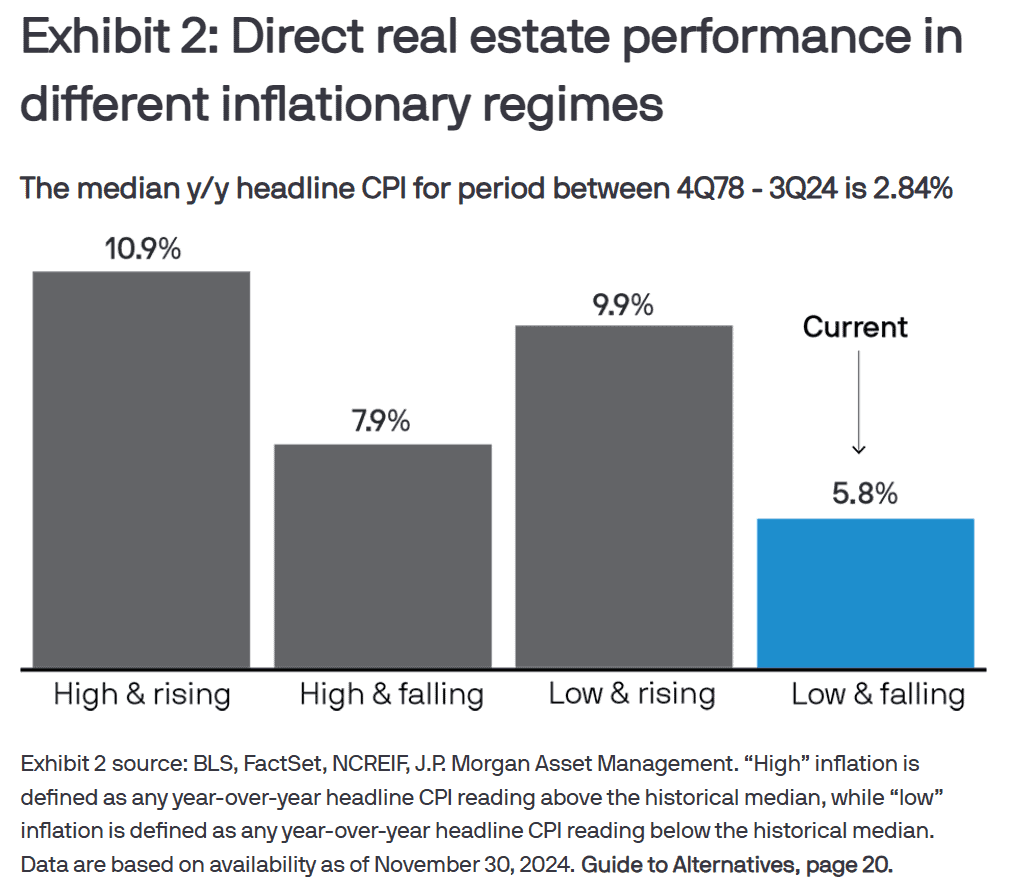

Inflation hedge

On the other hand, real estate returns—accessible through securitized bonds—tend to perform better in inflationary environments, since higher costs are typically reflected in rental prices. Furthermore, during inflationary periods, the values of both residential and commercial properties also tend to increase.

Stability

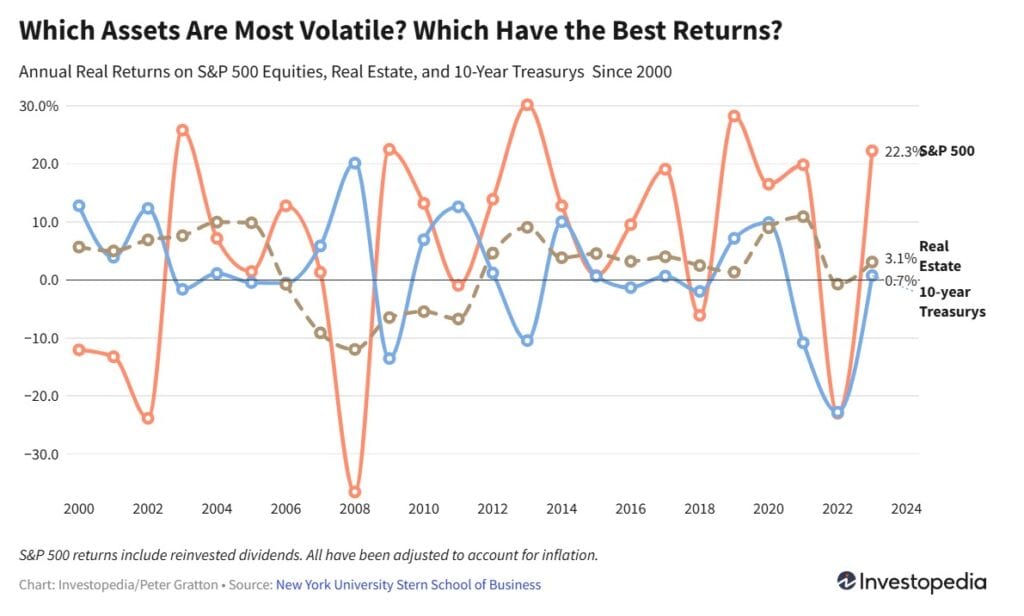

Real estate project-backed securitized bonds also typically exhibit lower volatility, thanks to the stable nature of their underlying assets.

A clear example of this was seen at the onset of the COVID-19 pandemic. Specifically, the average U.S. property price fell by just 3.4% between Q1 and Q2 of 2020, while the S&P 500 plummeted by around 33% during the same period, according to data from New York University.

Moreover, the stability of real estate is enhanced by rental income distribution. “A well-located residential or commercial property can provide a steady stream of cash flow through rental income, while the property itself appreciates in value over time. This allows investors to benefit from both ongoing income and potential capital gains when the property is sold,” notes IP Global.

Liquidity

Lastly, one of the strongest advantages of securitized bonds is their typically high liquidity. Once the securitization process is executed, the real estate projects transformed into these bonds can be bought and sold more easily than through traditional redemption and subscription mechanisms.

This allows the developer behind the units to obtain financing through bond issuance, and fund managers interested in the investment can enter and exit the opportunity with ease and a lower risk of executing trades at unfavorable prices.

“Liquid assets tend to be less volatile, meaning they show less variation in price changes. As a result, they’re considered less risky, since there’s a lower chance of a significant price drop and less uncertainty regarding price evolution,” explains Balanz Capital.

Conclusion

For all these reasons, securitized bonds present a viable option for asset managers seeking to participate in the real estate market—while enjoying additional benefits.

To learn more about FlexFunds’ asset securitization program, feel free to reach out to our team of specialists . We’ll be glad to assist you!

Sources:

- https://www.globenewswire.com/news-release/2025/01/27/3015707/0/en/Real-Estate-Market-Size-to-Hit-USD-7-84-trillion-by-2033-Straits-Research.html

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-alternatives/portfolio-discussions-direct-real-estate/

- https://www.mdpi.com/1911-8074/17/4/160

- https://www.investopedia.com/ask/answers/052015/which-has-performed-better-historically-stock-market-or-real-estate.asp

- https://www.ipglobal-ltd.com/insights/real-estate-vs-stocks-why-global-property-remains-a-safe-investment/

- https://balanz.com/balanz-university/que-es-la-liquidez/