- This article compares two investment vehicles, namely FlexPortfolio and AMC, showcasing the numerous advantages of the former over the latter.

- The information in this article is valuable for portfolio managers and investment advisors who are considering establishing an investment vehicle as a financial instrument to optimize their strategy and objectives.

- FlexFunds specializes in the design and issuance of investment vehicles, and with the FlexPortfolio, it can offer innovative and personalized solutions. If you wish to delve deeper into the products developed by FlexFunds and determine which solution best suits your needs, do not hesitate to contact our team of specialists.

What is the FlexPortfolio?

The FlexPortfolio is a product aimed at asset managers that allows them to provide simplified, turnkey solutions to create their unregulated investment vehicle. This vehicle securitizes a wide range of listed assets, such as stocks, options, futures, bonds, currencies, and ETFs.

In addition to its simplicity compared to other investment vehicles, it provides asset managers with the mechanism to quickly and efficiently establish an investment structure for implementing their liquid investment strategies, utilizing various possible underlying assets that compose it.

What is an AMC?

An Actively Managed Certificate (AMC) is a type of structured financial product, typically issued by a financial institution, that combines the characteristics of actively managed funds with certificates or notes. It is targeted at investment professionals who make decisions regarding the composition of underlying assets to achieve their goals and generate returns that outperform the market.

An AMC provides exposure to a diversified portfolio of underlying assets, including stocks, bonds, commodities, or any other financial instrument, while incorporating active management strategies outlined in the investment contract.

What are the main advantages of a FlexPortfolio over an AMC?

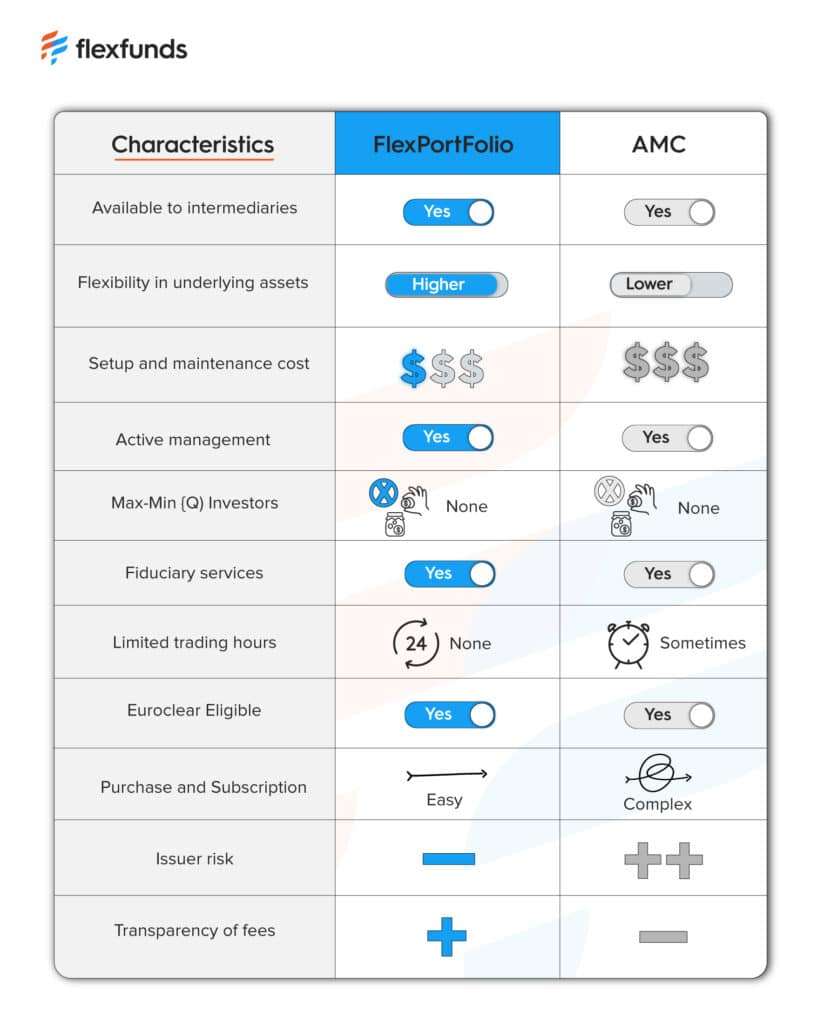

The FlexPortfolio is a solution that undoubtedly offers numerous advantages and is a more efficient alternative to investment vehicles such as traditional mutual funds, UCITs, or AMCs. In the specific case of AMCs, Table 1 provides a more detailed comparison from which the most relevant advantages can be extracted, as follows:

Launch Time and Costs

- The creation and launch period for FlexPortfolio typically ranges from 6 to 8 weeks, while an AMC demands more time due to its greater complexity and involvement of third parties.

- Unlike an AMC, FlexPortfolio may have no setup or maintenance costs, which can make it more cost-efficient.

The FlexPortfolio can be an ideal vehicle for channeling investments in listed assets, as it reduces bureaucratic processes and time.

Distribution and Management

- The FlexPortfolio allows the design of globally distributed investment strategies since it is a “Euroclearable” investment vehicle, enabling international operations with a transparent and standardized product. This facilitates asset protection and access to various counterparties that enhance liquidity and asset optimization within an international legal framework.

- In the case of AMCs, liquidity is more limited, as it may not always be as easy to buy or sell shares at any given time. In contrast, the FlexPortfolio offers daily liquidity from the issuer.

- Regarding management, the FlexPortfolio allows investors and managers direct access and operation of the brokerage account 24/7, with minimal or no restrictions on the account rebalancing process and without needing third-party involvement, unlike an AMC. Therefore, it is ideal for asset managers seeking a quick and efficient investment structure to launch their liquid strategies.

Flexibility, Transparency, and Complexity

- Although an AMC has a certain degree of flexibility in creating and structuring financial products, it sometimes exhibits limitations compared to the FlexPortfolio, which offers greater flexibility in the underlying assets and leverage for numerous strategies. It provides higher customer satisfaction through a more efficient and transparent design of personalized solutions tailored to each investment profile.

- The FlexPortfolio provides greater investor-facing transparency than an AMC, as it is required to disclose as much information as possible about the underlying assets that comprise it, allowing investors to make more informed decisions.

- The complexity of an AMC is higher because it can be difficult for a qualified investor to understand, both due to its terms and conditions and payment and return structures.

Risk Management

- The FlexPortfolio allows investment in a wider range of assets, enabling greater portfolio diversification in terms of asset types and potential investment strategies, reducing risk by increasing diversification compared to AMCs, which often present greater challenges in risk management.

- Due to the lower transparency of an AMC regarding the exact composition of underlying assets and investment strategies used, risk assessment for investors is more complex.

Table 1. Key Features of the FlexPortfolio vs. AMC

| Characteristic | FlexPortfolio | Active Management Certificate (AMC) |

|---|---|---|

| Type of investment | ETP | Investment fund |

| Flexibility | High | Medium |

| Transparency | High | Medium-low |

| Fees | Lower | Higher |

| Complexity | Low | High |

| Structured product | No | Yes |

| Liquidity | High | Limited |

| Launch time | Short | Medium |

| Setup and maintenance costs | - | + |

| Account operation | Direct 24x7x365 No need for third-party involvement | Requires third-party involvement |

| Issuance security | Independent of the promoter's activities | The issuer can appoint a third party. |

| Efficiency | Higher | Lower |

In conclusion, it can be affirmed that, in general, the FlexPortfolio is a much more flexible, efficient, transparent, and cost-efficient solution than an AMC. It can be created in a shorter timeframe and offers a broader range of underlying assets.

Make the Right Decision

Consider our FlexPortfolio when evaluating an AMC or any other investment vehicle, as it is always advisable to compare which solution best suits your needs and investment strategies.

If you would like to learn more about FlexPortfolio, do not hesitate to contact our specialized team at FlexFunds.