- The distribution of investment strategies internationally allows investors to seize opportunities in different markets, further diversifying their portfolios and reducing risks.

- FlexFunds’ ability to securitize underlying assets that can withstand the impact of inflation translates into a valuable tool for protecting and growing wealth in a challenging economic environment.

- Investment vehicles are emerging as essential tools to mitigate the adverse effects of inflation.

In recent times, inflation has become one of the main global economic challenges and a major concern for central banks, which have tried to contain it primarily through higher interest rates.

In finance, a scenario of higher interest rates also becomes challenging, demanding a higher degree of adaptability and innovation from asset managers as they navigate their clients through rough waters, according to FlexFunds, a leading company in the design and launch of investment vehicles.

FlexFunds’ approach focuses on offering advanced asset securitization solutions that enhance the distribution of investment strategies and facilitate quick and cost-effective access for international investors.

These aspects are crucial as the escalation of global inflation puts pressure on financial markets and adds greater uncertainty to an already complicated economic landscape post-pandemic, with high public debt, reduced consumer confidence, and conflicts in Ukraine and the Middle East.

According to the PwC Global Asset & Wealth Management survey1, the biggest concerns for investors and asset managers over the next 12 to 24 months are inflation, market volatility, and interest rate movements. This result aligns with the sentiments expressed by portfolio management executives and investment experts from over 80 companies in 15 countries across LATAM, the U.S., and Europe in FlexFunds’ First Annual Report of the Asset Securitization Sector.

In 2022, global assets under management experienced the largest drop in a decade, falling to $115.1 trillion, nearly 10% below the 2021 peak of $127.5 trillion. However, PwC anticipates that “as the global economy rebounds and inflationary and interest rate pressures ease,” the industry’s global revenues will advance to $622.1 billion in 2027, surpassing historical highs.

Asset Managers’ Strategies: How to Face This Landscape and Preserve Wealth?

In this scenario, asset managers face the challenge of protecting wealth and shielding their clients by leveraging tools that the current market offers despite all the obstacles on the horizon.

Professional services firm Ernst & Young (EY) urges asset managers to make better decisions regarding expense optimization and savings generation to withstand current headwinds. This involves different approaches such as “exiting sub-scale markets, combining retail and institutional capabilities, or monetizing support functions like technology or risk management2.”

To cope with market uncertainty, organizations are also encouraged to maximize growth areas in fields such as alternative investments, rethink their offerings with a focus on emerging industries like new technologies, and leverage tools such as artificial intelligence to be more efficient. Another fundamental aspect is providing customer-centric experiences to all investors, addressing concerns like digitizing distribution to offer personalized added value.

-Global revenues for the asset and wealth management industry will recover as the global economy rebounds and inflationary and interest rate pressures ease, according to PwC.

In times of high inflation like the present, asset managers not only focus on making changes to their business structures but also analyze what kind of investment vehicles can offer broader coverage against rising prices without reducing exposure or sacrificing returns.

As stated by analysts at BNP Paribas, “inflation can have a corrosive effect on uncovered portfolios by eroding the value of debt-based securities.”2 Therefore, it is considered crucial to reduce risk through data analysis to understand which assets are most vulnerable or which ones retain their value when prices rise. Additionally, diversification is seen as a strategic approach to mitigate global market volatility through broader exposure.

Inflation Projections for Markets

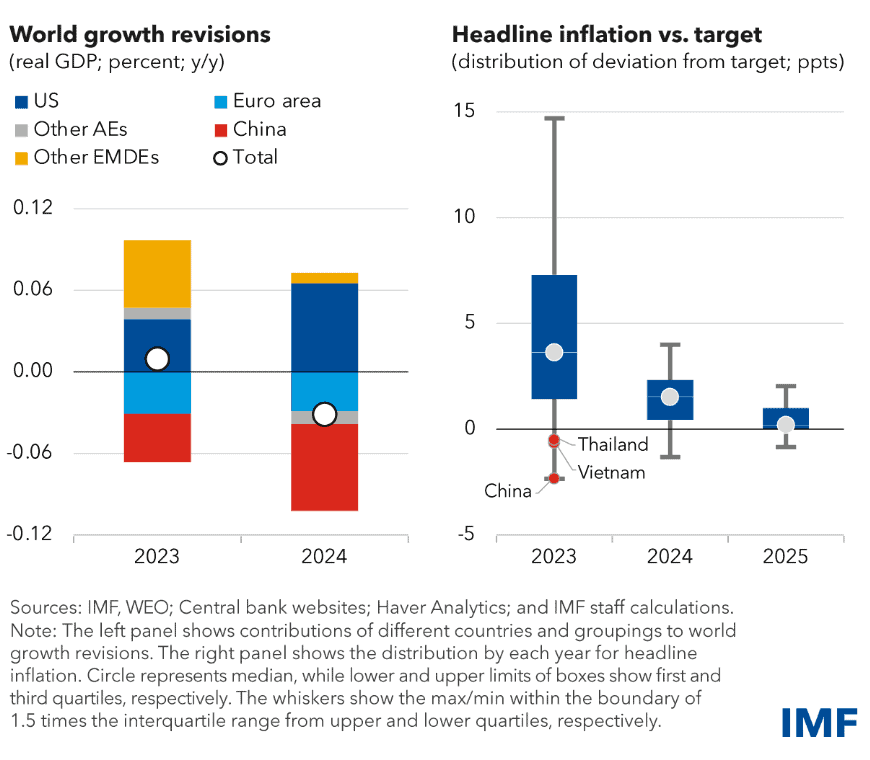

According to projections from the International Monetary Fund3 (IMF), it is likely that inflation will not return to target levels until 2025 in most countries worldwide. Nevertheless, the IMF highlighted in a recent report that general inflation continues to decelerate from 9.2% in 2022 on a year-on-year basis to 5.9% this year. Meanwhile, it expects inflation to touch 4.8% in 2024. (Graph credit: IMF).

But “while they have decreased, both overall and core inflation remain too high. Short-term inflation expectations have risen significantly above their target level, although this trend seems to be turning,” the IMF warns.

This scenario could continue causing shocks in financial markets over the next months, so asset managers should remain vigilant and begin to act to protect wealth and preserve financial stability.

In current market conditions, asset managers find in FlexFunds’ investment vehicles an alternative that combines innovation, efficiency, and adaptability. The company’s ability to securitize underlying assets that can withstand the impact of inflation offers portfolio managers a valuable tool in the quest to protect and grow their clients’ wealth in a challenging economic environment.

FlexFunds’ Keys in an Inflationary Environment

The diversification provided by a securitized portfolio through a FlexPortfolio, along with the inclusion of alternative assets in a FlexFeeder, gives portfolio managers an effective strategy to protect their wealth and that of their clients in an inflationary environment.

FlexFunds’ ability to facilitate quick and efficient access for international investors becomes a key element in times of global inflation. The distribution of investment strategies internationally allows investors to seize opportunities in different markets, further diversifying their portfolios and reducing risks.

-In times when financial stability is essential, FlexFunds’ innovation, efficiency, and adaptability stand out as valuable resources in pursuing security and financial growth.

One distinctive factor of FlexFunds’ ETPs is the speed with which they can be designed. With a launch time half that of market alternatives, FlexFunds demonstrates its agility and ability to quickly adapt to changing economic conditions.

Sources:

- https://www.pwc.com/gx/en/news-room/press-releases/2023/pwc-2023-global-asset-and-wealth-management-survey.html

- https://securities.cib.bnpparibas/inflation-investment-impact/

- https://www.imf.org/en/Blogs/Articles/2023/10/10/resilient-global-economy-still-limping-along-with-growing-divergences