Real estate investment funds, better known as REITs, can be an alternative to start generating returns from the real estate market without investing directly in a property. But what are the pros and cons of this instrument?

Although its origins date back to the 1960s, this type of investment instrument has gained more attention recently. It has positioned itself as an important alternative in the real estate sector. REITs are a type of fund that is constituted through a publicly traded company and owns various assets in the real estate sector to obtain returns from them through, for example, their rental.

The asset basket that makes up a REIT fund includes everything from offices, residential real estate, shopping malls, hotels, and industrial-use properties. These companies must invest at least 75% of their assets in real estate, and to be incorporated, they must have a minimum of 100 shareholders, according to IG.

Its role has been vital so that more investors can be exposed to the real estate sector and generate returns derived from projects of important projection without having to be direct partners with them.

Through REITs, investors acquire packages of shares of these publicly traded companies, and professional fund managers manage these assets to generate those returns.

What types of REITs exist, and how to participate in them?

The real estate investment fund business has three main categories: REITs that focus on property investments, those specializing in mortgages, and mixed REITs.

REITs that invest in property are the most popular and are primarily focused on managing assets for rental income or sales appreciation.

Mortgage REITs provide financing for real estate development and profit from the interest earned on these loans. And the mixed ones develop the two schemes to offer returns to their shareholders either through properties or mortgages.

Some options to invest in this instrument include specialized investment funds or ETFs, which aim to “replicate the investment results of an index made up of real estate investment trusts,” as the American investment management firm BlackRock explains. Likewise, you can start investing by directly buying REIT shares.

REIT: What returns do they generate?

Although REITs have been characterized in recent decades for offering attractive returns, it must be borne in mind that they correlate with the markets as they are financial assets and therefore are more susceptible to their volatility compared to traditional investment in real estate.

On the other side, REITs offer significant liquidity to investors. In markets like the US, these funds must distribute at least 90% of their annual net income through dividends to different shareholders, according to the regulation defined in that country. Thanks to this, REITs have certain tax benefits since these companies are generally exempt from corporate taxes.

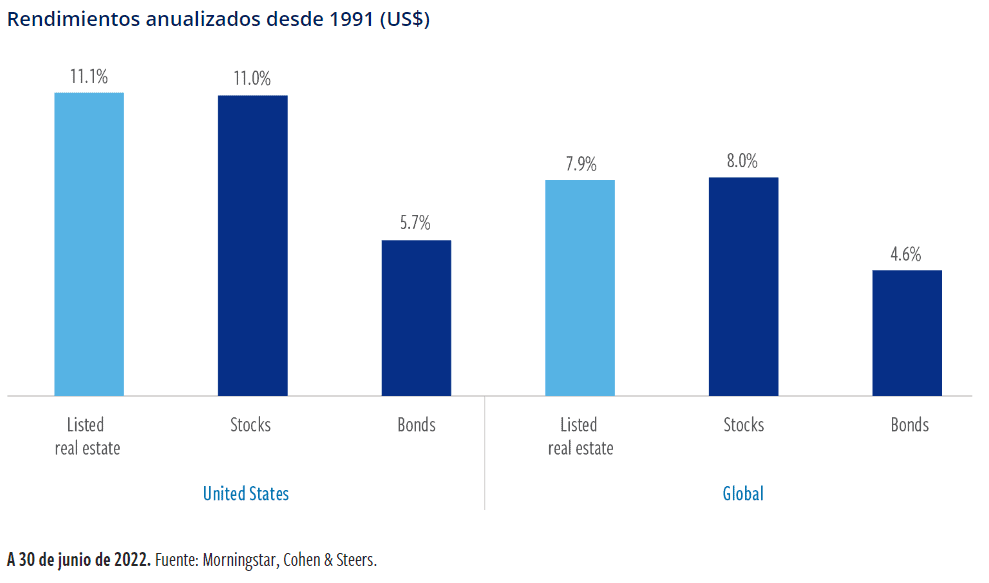

REITs are estimated to generate average absolute and relative returns of 11% annually in the US. In comparison, globally, this can be as high as 7.9%, thanks to “stable business models, focused on “acquiring and developing high-quality assets that generate recurring lease-linked income,” according to an analysis by US investment management firm Cohen & Steers.

How much is this business growing?

According to the National Association of Real Estate Investment Trusts (Nareit), until the end of 2022, REITs had some US$4.5 trillion in gross real estate assets in the US and owned more than 535,000 units in that country.

REIT funds contributed about 3.2 million full-time jobs in the US in 2021. They also help finance 1.7 million homes in that market.

The business size can be measured with the market capitalization of the REITs listed in the US, which is estimated at US$1.4 trillion, according to Nareit figures. This association highlights that this business has proven resilient despite a more challenging economic outlook for 2023.

According to its 2023 outlook report, “REITs are well positioned to navigate the market and economic uncertainty.” Past experiences have shown that this instrument outperformed private real estate before and during a recession. In addition, Nareit identifies that “the operating performance of REITs keeps pace with inflation.”

With this scenario, some experts believe that REITs can be an exciting option for investors looking for an instrument that offers liquidity and allows them to diversify their portfolios without worrying about buying and managing this real estate. At the same time, in situations like the current ones, they can serve as shields against inflation at a time when rental prices also respond to this price dynamic, as they are indexed in many cases to the CPI.

However, as in any investment, you must be aware of the risks associated with the natural fluctuations of the markets and the frequency in which you will receive income, among other aspects that must be considered and studied to take advantage of the benefits offered by REITs in the best way.

Sources:

- https://www.ig.com/es/estrategias-de-trading/-que-son-los-reits-y-como-operar–230209#son

- https://www.blackrock.com/mx/intermediarios/productos/239482/ishares-cohen-steers-reit-etf

- https://www.cohenandsteers.com/insights/strong-foundations-the-case-for-real-estate-securities/