COMING SOON

Flex FinTech

Give your clients easy access to the financial equity markets from their own mobile phone with a trading platform under your brand.

No-Code

Hassle-free

Easy to Set Up

Personalize the platform with your logo and colors and offer your clients your own branded platform quickly and with no development headaches.

Powered by FlexInvest

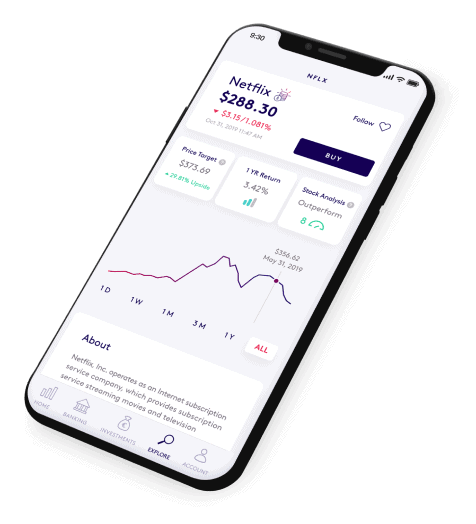

Investment Solution

Simplify client investing journeys by integrating our investing app to your business. Our mobile app is compatible with iOS and Android. It includes onboarding, market monitoring options, investment exploration pathways, investment tracking, real-time transactions, watchlists, deposits and withdrawals, history and account reports, alerts, a fully customizable module appearance, and mobile security.

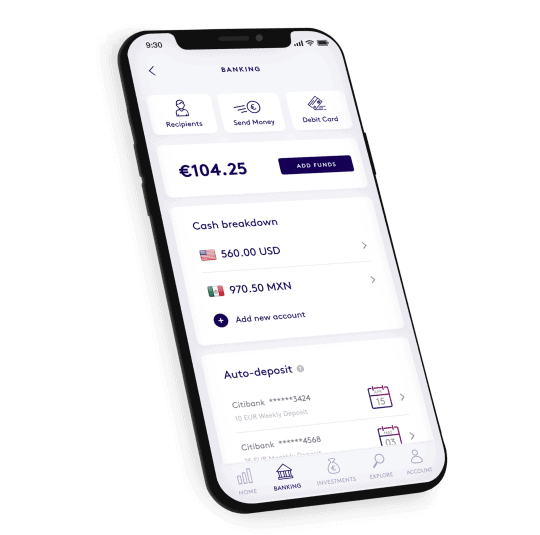

Banking Solution

Your customers can say ‘goodbye’ to financial barriers. Compatible with iOS and Android, our banking solution comes with configurable modules for client onboarding, multiple funding options, deposits and withdrawals, balances, send and receive money transactions, FX transactions, physical and virtual debit card issuance, debit card management, budgeting, alerts, and mobile security.

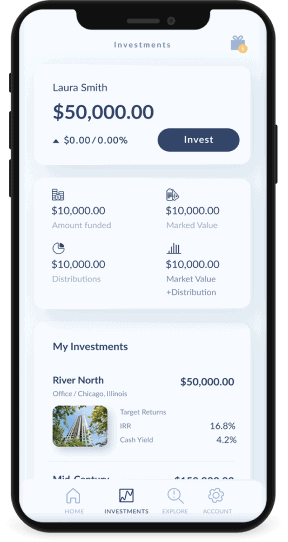

Private Placement

Real Estate Solution

Allow investors to invest in single project or portfolios depending on your strategy. We provide you with a white label mobile app ready to use, compatible with iOS and Android. It includes onboarding, project exploration, important document location, portfolio management and market values, alerts, and mobile security.

User friendly back-end control panel

Compliance

- Onboarding

- KYC

- Documents and reports

- Logs & Auditing

- Risk Profile

- AML processes

- Report and alerts

Money Management

- Deposits

- Withdrawals

- Internal Transfers

- FX transactions

- Balances

- Reports and alerts

Investment

- Real-time transactions

- Order management

- Fractional shares

- Order Types

- Order Feed

- Assets inventory and management

- Reports and alerts

Margin

- Fully configurable interest rates, multiplier, collateral, and loan limits.

- Reports and alerts

Banking

- Single compliant connection to a variety of payment solutions

- Virtual bank account aggregation

- Processing and recording money deposits and cash withdrawal

- Currency exchanges

- Debit card issuance

- Reports and alerts

System Settings

- Users management

- Email alerts

- Instruments and symbols setup

- Activate or deactivate platform features

- Webhooks and providers integration

Save time and money with our turnkey platform

Brand it with your logo, colors, and features. You set your fees for all types of transactions. Plug-and-play go to market solutions only requires light setup. All components are real-time data and iOS/Android compatible.

flex

fintech

fintech

| Target Market | Retail, Credited & Institutional |

| Currencies | Acceptance of all Currencies |

| Available to brokers | |

| Customizable | |

| Real time data | |

| Analyst Ratings | |

| Access to global markets | |

| Fractional shares |

* Does not include operating licenses. Platform only.